The IRS Code 162 executive bonus plan is another tool businesses can use to attract, motivate, reward, and retain key employees. Companies can use tax-deductible dollars to meet the disability insurance needs of specific individual employees while potentially also helping them build assets under management.

Going a step further and adding a Return-of-Premium (ROP) rider can dramatically increase the benefits of the plans by helping the employees build assets under management.

IRS Code 162 Plan for Key Executives

Under Code 162, companies can use funds to provide life and/or disability income insurance to key executives. The executives receive policy ownership rights, can name their beneficiary(ies), and, in most cases, can access policy cash values.

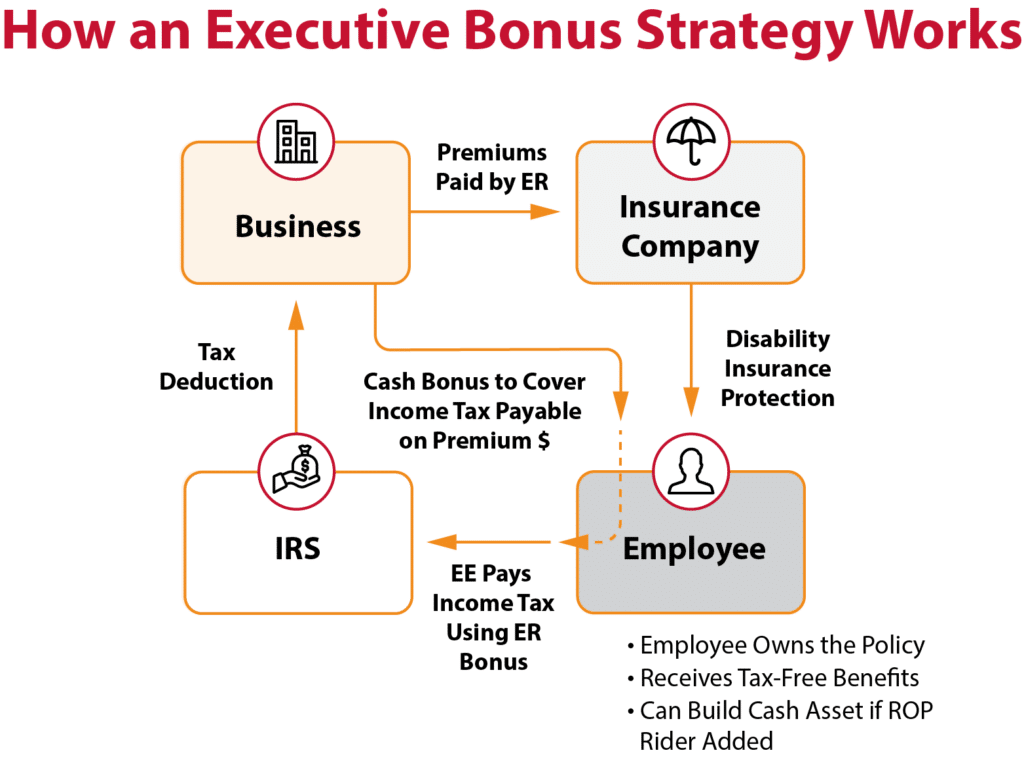

- Bonus plan design: Premiums are paid by the employer directly to the carrier (and reported as W-2 income to the executives).

- Additionally, the employer provides a cash bonus (reported on W-2) to cover the executive’s income tax on the premium amount, effectively making the disability benefits tax-free to the executive.

Regardless of the plan design, the company can write off all premiums, bonuses, and other expenses related to providing the coverage as long as the executive’s total compensation remains reasonable. Although not required, written plans are recommended to help avoid the disallowance of the employer’s expense deduction on the grounds of unreasonable compensation.

In addition to providing a powerful human resources asset, Code 162 executive bonus plans are popular for a variety of reasons, including:

- They are simple to implement and easy to administer, with no IRS approval or complex governmental reporting required.

- The company can choose which employees they wish to reward; the plan does not have to be offered to all employees within the same class.

- The amount of benefit provided can vary from employee to employee.

- Executive bonus plans are not subject to ERISA “qualified plan limits.”

- The insured employee owns the policy and has full policy rights, including beneficiary selection and cash value access.

- The insured employee does not have to tie up personal funds to cover personal life and/or disability income insurance needs.

Structuring a Plan for Everyone

If the business would like to provide disability benefits for the entire team, not just the C-suite, the broker can present a small group plan to covers everyone, and then carve out the executives to receive the additional stronger benefits on top.

IRS Code 162 Plan including ROP Rider to Help Build Assets

To further sweeten the bonus plan’s power as a tool to attract, motivate and retain key employees, companies may want to add a Return-of-Premium rider that builds cash assets for the employee if they stay with the company for a certain period and hasn’t filed to claim for disability benefits under the policy.

ROP riders are available at 50%, 80%, or 100% refund levels and for various term lengths, typically 10 years. Many consider an 80% ROP at 10 years a good balance between additional premium cost and potential return.

Want to set up a plan for your clients? Contact us for guidance, and for more information on executive benefits. Also, download our Section 162 Guide as well as our Guaranteed Standard Issue Disability Insurance Guide.