The healthcare industry is booming. According to the U. S. Bureau of Labor Statistics, employment for physicians and surgeons is expected to increase by 13 percent between 2016 and 2026. This is much faster than the average expected growth of all occupations.

The healthcare industry is booming. According to the U. S. Bureau of Labor Statistics, employment for physicians and surgeons is expected to increase by 13 percent between 2016 and 2026. This is much faster than the average expected growth of all occupations.

All these new doctors are going to need disability insurance. According to the Medscape Physician Compensation Report, doctors made an average of $204,000 to $443,000 in 2016, depending on specialty. This impressive salary means they have a lot to risk if an injury or accident prevents them from working. At the same time, doctors have a lot of student debt – an average of $166,750 according to this CBS News report. As a result, they need to make sure than they have a steady income no matter what happens.

And doctors know exactly what can happen. They see illness and injury every day, and they understand just how real the risks are. It’s no wonder that many doctors make the smart choice and elect to buy disability insurance.

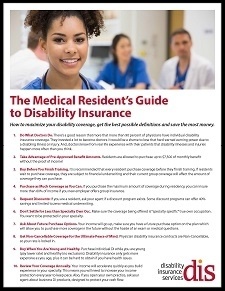

Fewer medical residents opt for the coverage, despite the advantages that come with early enrollment. Residents can benefit from pre-approval without proof of income, low rates, and no exclusions. Because they can review their coverage annually and increase protection to match earnings, there’s no reason for them to wait until they’ve finished training to buy disability insurance.

Also, because medical residents are less likely to have disability insurance already, selling to them is a great way to begin selling to the medical industry. If you’d like to tap into this market, download our all new Medical Residents Sales Kit and start selling disability insurance to medical residents today.

Also, because medical residents are less likely to have disability insurance already, selling to them is a great way to begin selling to the medical industry. If you’d like to tap into this market, download our all new Medical Residents Sales Kit and start selling disability insurance to medical residents today.

Discover more resources to help you succeed selling disability for doctors.