Did you know that April was National Financial Literacy Month and May is Disability Insurance Awareness Month? Just as April showers brings May flowers, financial literacy often leads to an increase in disability insurance protection.

Did you know that April was National Financial Literacy Month and May is Disability Insurance Awareness Month? Just as April showers brings May flowers, financial literacy often leads to an increase in disability insurance protection.

According to Andrea Hasler at the Global Financial Literacy Center, decision-making and financial literacy are related. The poor showing of the general population in these areas is a challenge for every advisor.

You’ve read the statistics and facts about the likelihood of suffering a disability, the common types of conditions cited when applying for benefits, and the length of time disabled. However, here are some less-known facts about the Social Security disability benefit and the variables in the taxation of private disability insurance benefits both of which can have an impact on the client’s decision-making about the need for disability insurance.

Social Security Disability vs. Private Disability Insurance

Those who believe that the federal government disability insurance program will cover them should be aware of a few facts:

- The monthly benefit averages less than $1,200

- Only 34 percent of first-time applications for benefits are approved

- The appeal process for applicants initially denied averages between three – six months.

- To qualify, the applicant must be:

- Unable to work for twelve months

- Totally disabled – partial disability does not qualify

- Unable to continue to perform tasks of current employment and the medical condition prevents the applicant from working in other capacities

Clearly, relying on the Social Security Disability program as the sole provider of benefits may result in a lifestyle far different than expected.

Taxability of Disability Benefits

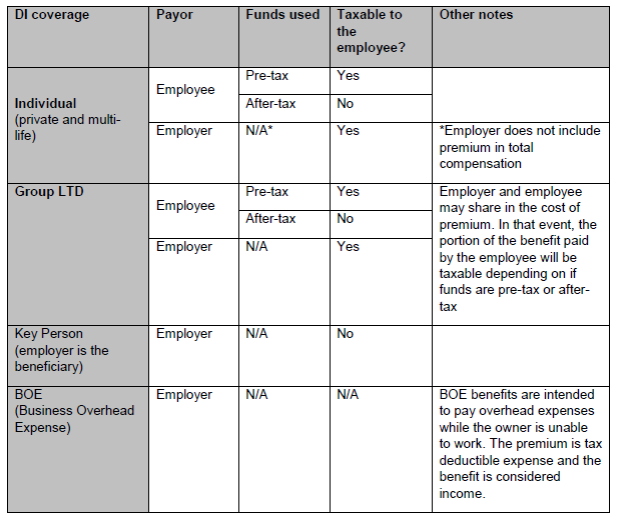

Those who believe that their work-sponsored coverage is sufficient should know more about the taxability of their benefits. At least two considerations impact the taxability of benefits; 1) who pays the premium and 2) whether the premiums are paid with pre-tax or post-tax monies. The chart below illustrates the variables. Of course, specific tax questions should be directed to a tax or legal advisor– these are just general guidelines.

A claimant expecting the monthly disability benefit to be 60 percent of salary will be surprised to learn the benefit is something less because taxes are withheld. Understanding these arrangements is essential to the financial plan. Individual circumstances can affect the taxability of an insurance benefit. As always, a tax professional should be consulted for specific situations.

Look to DIS for information about all aspects of disability insurance, from benefit explanations, to marketing, to sales ideas. Contact your DIS representative for any disability insurance related needs.