Thanks to COVID-19, Americans are more focused on their well-being and resilience: physical, mental, emotional, and financial. Nearly 60% admit to having completely changed how they think about money because of the pandemic and say that their perceptions of economic well-being have shifted.

This has created the best opportunity in some time to sell individual disability insurance policies. People are far more conscious of the need to prepare for unexpected disruptions in their financial lives. In fact, 48% have increased the amount of money they believe they should set aside for a “rainy day.”

Risk of Disability

Paying for basic living expenses if they become disabled is one of the top five financial concerns people have – but 80% don’t own disability insurance. Only 48% believe they even need it.

That’s according to research from LIMRA, which also found that the most frequent reasons people give for not buying disability insurance are a lack of knowledge and indecision.

The Social Security Administration reports that the average 20-year-old has a 1-in-4 chance of becoming disabled before they reach retirement age.

Disability Insurance Basics

A disability insurance policy replaces a percentage of the insured’s salary if they are unable to work due to a disabling illness or injury.

A disability insurance policy replaces a percentage of the insured’s salary if they are unable to work due to a disabling illness or injury.

Even those who work sedentary positions are at risk of disability due to countless medical conditions like cancer and stroke. Injuries – such as those caused by car accidents and slip and falls – happen to young, healthy individuals more often than you might expect.

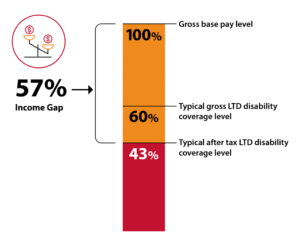

Individual disability insurance policies are also used to supplement work-based LTD plans that provide minimal benefits. Employer-provided benefits typically only provide 60% income replacement – up to a cap such as $5,000 per month – not enough for many high earners. Employer-provided benefits are also taxed so employees can be left with only 43% of their income to live on after tax – not enough for most people to cover their bills and maintain their quality of living.

Disability Insurance Cost and Potential Benefit

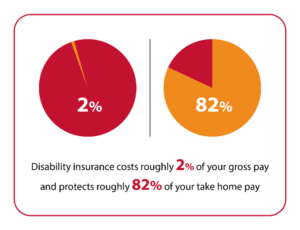

An individual LTD plan costs an average of 1-3% of the insured person’s salary and can replace up to 82% of their take home pay. In other words, a person earning $100,000 a year can expect to pay between $1,000 and $3,000 annually, or as little as $84 a month. Age, health factors and policy provisions are all factors that influence a policy’s cost.

An individual LTD plan costs an average of 1-3% of the insured person’s salary and can replace up to 82% of their take home pay. In other words, a person earning $100,000 a year can expect to pay between $1,000 and $3,000 annually, or as little as $84 a month. Age, health factors and policy provisions are all factors that influence a policy’s cost.

Customization Opportunities

In addition to portability, one of the advantages of an individual disability insurance policy is the flexibility to customize coverage for each person. Policy variables include:

- The income percentage that the policy pays

- How long the benefit payments continue

- How quickly the benefits start (waiting period)

- The definition of disability

- Renewal provisions (guaranteed renewable, etc.)

- Riders

Tips for Successful Selling

Helping clients secure individual disability insurance is financially and professionally rewarding. You can feel confident that you are helping people protect their earning power – their most crucial asset that makes all other assets possible.

- Know which clients are not good candidates. IDI is not appropriate for clients whose earnings are below $50,000 annually (can’t afford the premiums), who are independently wealthy (can survive the cost of disability on their own), and those who have high unearned income, such as from rental properties or investments (disability insurance replaces only earned income).

- Establish how much of a shortfall the client would have if they couldn’t work. If they become disabled, the income stops, but their bills don’t. Many disability insurance underwriters offer a helpful online calculator for this discussion.

- Educate the client about their risk of disability. The DI Stat Pack provides an excellent foundation for discussions. .

- Follow a proven sales script, The Wealth Preservation Plan, to illustrate why individual disability insurance is an essential protection, and to show that it’s more affordable than many other kinds of insurance.

- Use sales tools and fliers available through Disability Insurance Services. Download the Baker’s Dozen as a starting point.

- Remind the client that their employer-provided group plan may not pay enough. Group plans may not be based on the client’s total income from all sources and may have ceilings or unusually long waiting periods.

- Ask any client who refuses coverage to sign a Waiver of Liability form to help protect you from future E&O claims.

For more information on Individual Disability Insurance and help create the right protection package for your clients, contact Disability Insurance Services at (800) 898-9641 or Request A Quote.