People are earning more. Their paycheck protection might not be keeping up. Group long-term disability benefits often include monthly caps that severely limit the amount of protection available to high-income earners. As inflation and wages increase, the income protection gap may be growing. It’s time to talk to clients about their supplemental coverage options.

People are earning more. Their paycheck protection might not be keeping up. Group long-term disability benefits often include monthly caps that severely limit the amount of protection available to high-income earners. As inflation and wages increase, the income protection gap may be growing. It’s time to talk to clients about their supplemental coverage options.

Inflation Is Surging

The Consumer Price Index increased 7% between December 2020 and December 2021, according to the U.S. Bureau of Labor Statistics. Food prices increased 6.3% during this time period, but the cost of meat, poultry, fish and eggs went up 12.5%. Energy costs were up 29.3%. According to Bloomberg, this is the annual biggest inflation gain since 1982.

Americans are feeling the squeeze. Civic Science found that 87% of people are worried about inflation, with 46% saying they’re very concerned and 27% saying they’re buying less because prices are higher.

Many people are already struggling to stick to their budgets as inflation soars. So what happens if their budgets take a major hit? Group long-term disability insurance often replaces only about 60% of a person’s regular income. Scraping by on that amount is getting harder and harder as prices increase. But that’s not the only complication …

Wages Are Rising, Too

Although inflation is a problem for many people right now, some workers may be getting some relief in 2022. In response to the Great Resignation and the resulting talent war, many employers are planning to give out raises in 2022.

Some of these raises will be substantial. Grant Thornton surveyed HR leaders and found that 88% expect average merit raises to exceed 3%, and 51% expect average merit raises to exceed 5%.

Raises are a good thing for employees, but there are some consequences that employees might not consider. One of these consequences is the income protection gap.

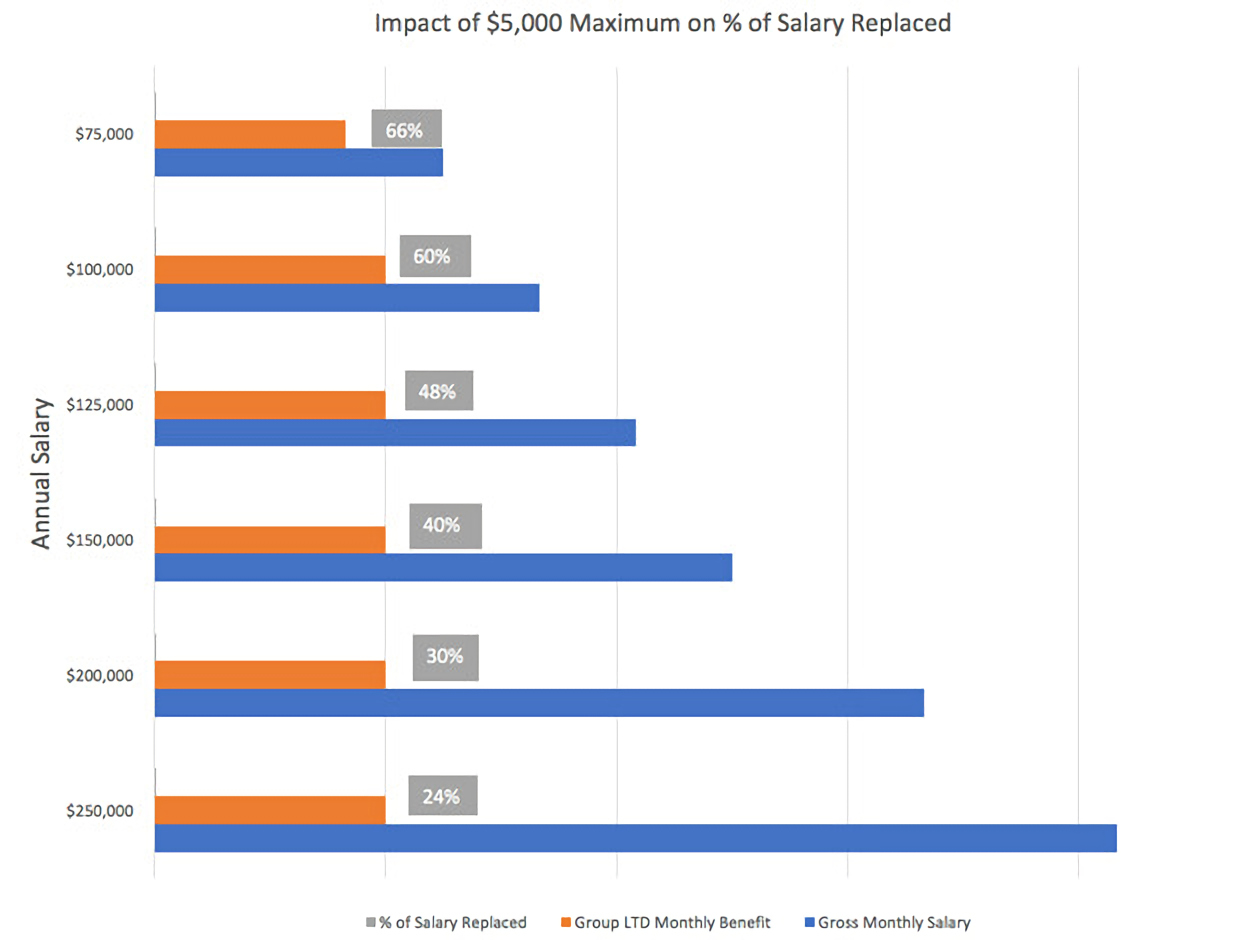

Most group long-term disability insurance policies replace around 60% of a person’s income – as a maximum. Some people will have a much smaller percentage of their income replaced due to monthly benefit caps. Many policies only provide a maximum payout of $5,000 a month. For people earning more than about $100,000 a year, this can start to become a problem.

A person earning $125,000 might only get 48% of their salary replaced. A person earning $250,000 a year might only get 24% of their salary replaced. As wages rise, the income protection gap gets bigger and bigger.

Group LTD Benefits May Not Be Enough

For many workers, group long-term disability benefits simply don’t offer enough protection. This has been true for a long time, but the situation is getting more urgent.

Many Americans experienced financial hardships during the pandemic. Even people with good jobs and good salaries were at risk as widespread shutdowns triggered layoffs. According to CNBC, 14% of Americans say they wiped out their savings. That’s 46 million people.

Now many people are back to work, and they’re in a good position to demand better wages. It looks like the light at the end of the tunnel – but what if there’s another setback? It doesn’t have to be another global pandemic (or a continuation of the current one). Cancer, heart disease, mental illness, back pain – there are many ways a single illness or injury can upend a person’s life and prevent them from working.

There’s never a good time for a disability, but one of the worst times is right when you’ve used up all of your savings, right when inflation is making everything more expensive and right when you’ve just gotten a big raise that makes your paycheck more valuable than ever.

There Is a Solution

It’s not all doom and gloom. People are earning more and that’s a very good thing. They just need to take some precautions to make sure that income is protected as well as it can be.

A Guaranteed Standard Issue multi-life disability insurance policy is a great way to do this. The fact that it’s Guaranteed Standard Issue means that workers don’t need to worry about going through medical underwriting or being denied coverage. The fact that it’s a multi-life policy means that policyholders can benefit from savings.

GSI plans are available to groups of five or more employees. Employers should consider offering GSI multi-life coverage to high earners to supplement their group LTD coverage. Doing so benefits both the employees and the employer.

- The employee gets access to the income protection they need. As their earning power increases, their benefits need to keep up.

- The employer gets to use the extra benefits as a tool in their retention and recruitment efforts. Faced with high turnover rates, employers need to do everything they can to retain their top talent.

Right now, the income protection gap is growing, and that’s creating opportunity for GSI sales. Do you need help breaking into the GSI market? Contact your DIS representative.