Initially clients may doubt the need for paycheck protection. They may falsely believe that their health insurance coverage exempts them from incurring hefty medical bills. Yet studies find that even those with health insurance, experience escalating debt when managing serious illnesses and injuries. Those who are covered by high-deductible plans and plans with large out-of-pocket maximums are particularly vulnerable.

In fact, the Kaiser Family Foundation study found that high-deductible plans had a significant bearing on medical debt burdens. Families with high incomes are not exempt from this challenge. Of those struggling under the weight of medical expenses, more than 40 percent were from households with incomes greater than $50,000. Of those struggling to pay medical expenses, two-thirds of respondents cited an acute condition like a short-term illness or injury, or a hospital stay or accident, rather than chronic, long-term conditions.

While the unexpected budgetary impact of medical expenses is significant, the loss of income during these times magnifies the problem. Roughly 30 percent of study respondents reported decreased household income due to the inability to work. And medical debt is just the tip of the iceberg. When the paycheck stops, all types of debt and past-due payments ensue.

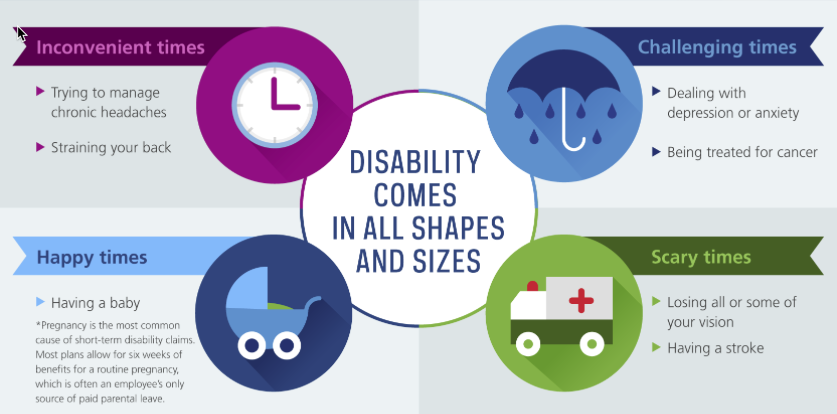

According to the Council for Disability Awareness, disabilities come in many disguises, often unrecognizable to the client as a condition that can be covered by disability insurance.

Cancer is the second most common disability diagnosis. Based on information from the US National Cancer Institute’s Surveillance Epidemiology and End Results (SEER) database, during our lifetime, 30 to 40 percent of us will be diagnosed with some form of cancer.

The cancer mortality rate has decreased 25 percent since 1990; survivorship rates continue to improve. The improving trend shows the progress of health care professionals to combat the disease. It also makes paycheck protection even more important. Cancer treatments are rigorous and may interfere with the ability to work.

Use this information to help your clients understand the crippling debt that comes from crippling injuries and illnesses. If you can shift your clients’ perspectives, you can close sales that will provide valuable protection.

Call us today for a quote or more information. Also, be sure to download our all-new client handout – “What is the Right Age to Buy Disability Insurance?”