Looking for an easy path to a multi-life account? Guaranteed Standard Issue disability insurance (GSI) is just the ticket. Designed for the multi-life market, GSI plans offer a guaranteed issue product and replace much of the income not covered by group long-term disability (LTD) plans. While these plans are attractive to employees of all income levels, executives and other highly-compensated employees often benefit most.

Looking for an easy path to a multi-life account? Guaranteed Standard Issue disability insurance (GSI) is just the ticket. Designed for the multi-life market, GSI plans offer a guaranteed issue product and replace much of the income not covered by group long-term disability (LTD) plans. While these plans are attractive to employees of all income levels, executives and other highly-compensated employees often benefit most.

All parties benefit from guaranteed issue disability insurance

The guaranteed feature usually means no or limited exclusions for pre-existing conditions. Even employees diagnosed with diabetes, heart disease, cancer, or other conditions that would typically be excluded as a covered condition is guaranteed coverage with no exclusions. GSI means no medical exams, blood work, or inspection reports. Unlike group long-term disability (LTD), policies are owned by the insured, not the employer; portable and usually retain the many premium discounts available. The own-occ definition is standard and, the salary definition often includes bonuses and other compensation.

Agents benefit when cases are enrolled more easily and issued faster without the risk of exclusions or denials. A multi-life case provides a stream of new revenue to the agent from employees added to the plan and from increasing salaries. Multi-life GSI pays full commission and introduces the agent to new, highly compensated clients who may need other financial services and products.

The value to the employer is the ability to provide additional income protection especially for executives who have a larger portion of their income unprotected. With multi-life GSI, the employer chooses how premiums will be paid, employee-pay, employer-paid, or a combination. Premiums are deductible as a benefit expense for employers who contribute to premium. Guaranteed Standard Issue policies may also be used in an Executive Bonus program (Section 162). Although often associated with life insurance, an individual disability policy works equally well.

Replacing a greater percentage of income

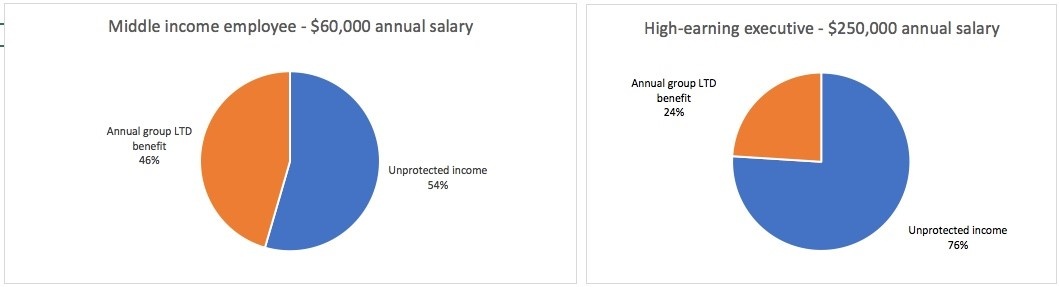

Group LTD policies are a good starting point for income replacement protection. But remind clients that a common LTD benefit of 60 – 65 percent of salary and a monthly benefit maximum of $5,000 may leave the insured with a considerable income gap, especially highly-compensated employees. Let’s look at two examples of the income gap when group LTD is the only income protection.

A middle-income employee earning $60,000 annually, participating in a typical employer-paid group LTD plan would have coverage for 65 percent of monthly income up to a maximum monthly benefit of $5,000. If the employee becomes disabled, as an employer-paid coverage the benefit the insured receives is subject to income tax and FICA deductions. Employees often underestimate the actual benefit amount.

The maximum monthly benefit cap of group LTD puts highly-compensated employees and executives at a disadvantage. The chart below shows how much more of the executive’s income is unprotected compared with the employee’s income.

Sharing a similar comparison makes it easy to persuade a benefit decision maker of the value of a GSI program. Because Guaranteed Standard Issue programs are multi-life individual disability products, not group products, the employer can easily offer the benefit to a select group, even if employer paid. The guaranteed issue feature eliminates the concern that an eligible executive may not be approved for coverage.

How to get started in multi-life GSI market

First, watch the video below to hear what Dan Steenerson has to say about guaranteed standard issue disability insurance products.

Next, identify clients who are business owners, benefit managers, or executives. Talk to employers, especially those with a group LTD plan, about how to reduce the underinsured income risk for company executives along with the flexibility of a GSI program; offering to a select group of associates, and choosing to pay all, some or none of the premium.

Talk to your DIS representative about our GSI products and carriers. A multi-life guaranteed standard issue disability insurance program is a great example of DI Done Right. Give it a try.