Selling Disability Insurance: Why and How

A person’s paycheck is often their most valuable asset. Unfortunately, many people are forced out of the workforce early due to illness and injury. Disability insurance is an important source of protection against this risk. Also called DI, income protection and paycheck protection, this coverage replaces part of the insured’s income if they can’t work because of a disabling condition.

Why Sell DI?

Lucrative Commissions

First, brokers can earn an excellent commission, which can be as high as 70%. Disability insurance sales are especially lucrative because the high renewal rate means that you can keep earning after you’ve sealed the deal, and with the Future Purchase Option rider, it’s even possible to earn a first-year commission on previous sales.

Important Disability Income Insurance Coverage for Your Clients

Selling disability insurance can also benefit your clients.

When people buy a house, have a child, or dream of retirement, they often forget to factor in how the high odds of disability can derail their plans. The CDC says that 61 million adults in the United States have a disability, and the Social Security Administration (SSA) says that one in four 20-year-olds will experience disability before reaching retirement age. Many people don’t qualify for SSA disability benefits and if they do, the benefits are very modest.

Disability insurance provides important income protection. If the policyholder can’t work because of an injury or illness, DI payments can help them stay afloat, keep their homes, and focus on their health, Some employers provide long-term disability insurance benefits, but your clients may still be interested in supplementing coverage with an individual disability insurance policy, which can provide higher benefit amounts and portable coverage.

Protect Your Career

There’s another reason to sell DI. Doing so may help you protect your insurance career.

Your clients count on you for insurance advice. If you don’t offer disability insurance and one of your clients experiences a disability that prevents them from working, you could be blamed for failing to offer coverage. You might even run the risk of being hit with an errors and omission lawsuit. By offering disability insurance, you’re giving your clients access to important coverage while protecting your own reputation.

Success in DI Sales: Establishing the Need for Disability Insurance

To be successful in selling disability insurance, you need to show prospects why they should spend money on paycheck protection.

1. Ask questions.

Encourage your prospects to think about what disability insurance means for them by asking thought-provoking questions, such as:

- How long would your savings last if you couldn’t earn a paycheck due to an injury or illness?

- How would losing your paycheck impact your lifestyle? What costs would you have to cut?

- How would losing your paycheck impact your plans for the future? Would you still be able to afford your dream retirement or pay for your children’s education?

2. Open eyes with compelling statistics.

Many people believe that disability could never impact them. However, many of the top causes of disability – such as back pain, heart disease, and cancer – are incredibly common, and no one is immune. You can raise awareness of the importance of disability insurance by sharing statistics on disability.

3. Drive home the need for coverage with compelling stories.

Although statistics make a compelling case for paycheck protection, individual stories can create a stronger emotional connection, and that can help you make more disability insurance sales. Share case studies and real-life stories of people who experienced disability and depended on disability insurance to make ends meet.

4. Encourage action.

When presented with the facts, many people recognize the need for disability insurance, but they may not feel a sense of urgency. As a result, many disability insurance sales are lost to procrastination. To make more disability insurance sales, you need to show why now is the best time to buy – i.e., because you never know when disability will strike, and rates will only increase as a person ages and experiences more health problems.

If selling disability insurance sounds like a lot of work, don’t worry. DIS has the resources and support you need to succeed in disability insurance sales.

What to Expect from DIS

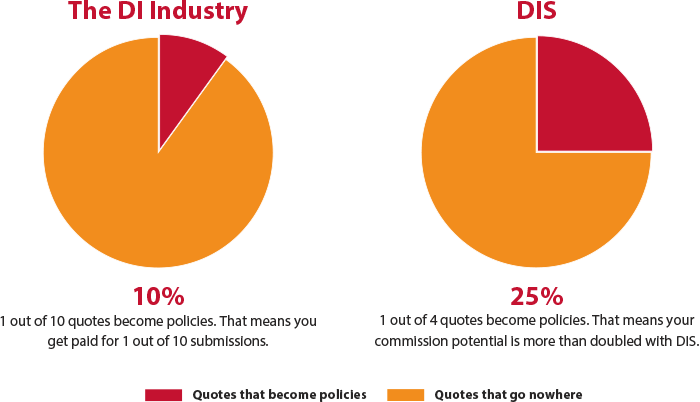

With DIS you’ll be supported by the best and brightest in the industry. You can count on us for access to top carrier markets, fast quotes, free sales coaching, back office support, case design and advocacy and an impressive library of educational pieces and sales tools. These differences can make a big difference in your bottom line. In the disability insurance industry as a whole, only about 10% of quoted DI policies are placed in force. DIS agents place 25% of quoted policies in force.

Its simple. With DIS, you can sell more and earn more.

The Tools You Need

Expanding into a new insurance product can be intimidating, but it doesn’t have to be difficult. We offer an effective sales script, a quote engine, worksheets, client handouts, videos, training and more. You don’t have to reinvent the wheel and you enjoy instant access to proven strategies and techniques so you can reach the next level faster. Best of all we offer free sales coaching and co-selling so you can advance confidently.

How to Get Started

DIS works with both new insurance agents who are just getting started and established insurance professionals who want to expand into DI or streamline their sales process. We also work with agencies and IMOs. If you want to sell DI, we want to be

your partner.

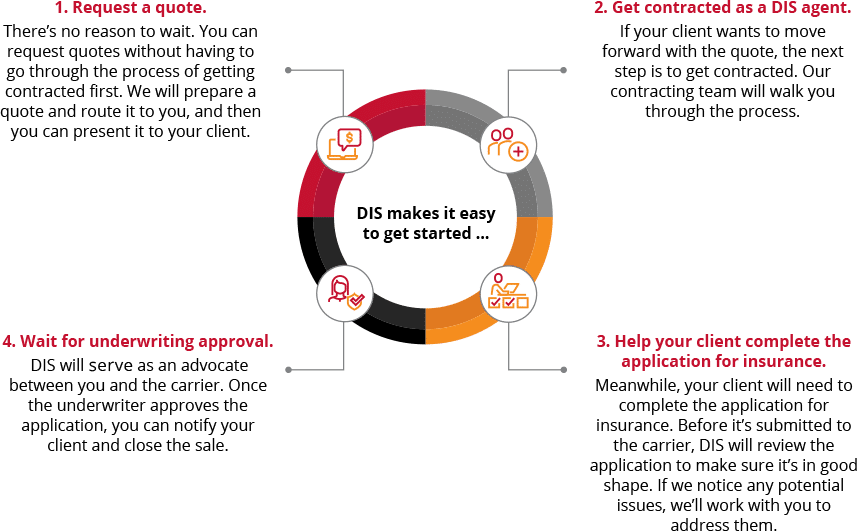

Start Selling DI in Four Simple Steps