Resources

At DIS, our mission is to help you educate your clients about the importance of income protection. We believe in selling by teaching – not by pairing a free quote with a high-pressure sales pitch. Never forget that you are protecting your clients’ most important asset – their earning power. Below you’ll find tools to help you create awareness, build interest and close sales.

Now it’s easier than ever to specialize in this growing market with our DI for Dentists Sales Kit.

Think about the investment that you’ve put into your career.

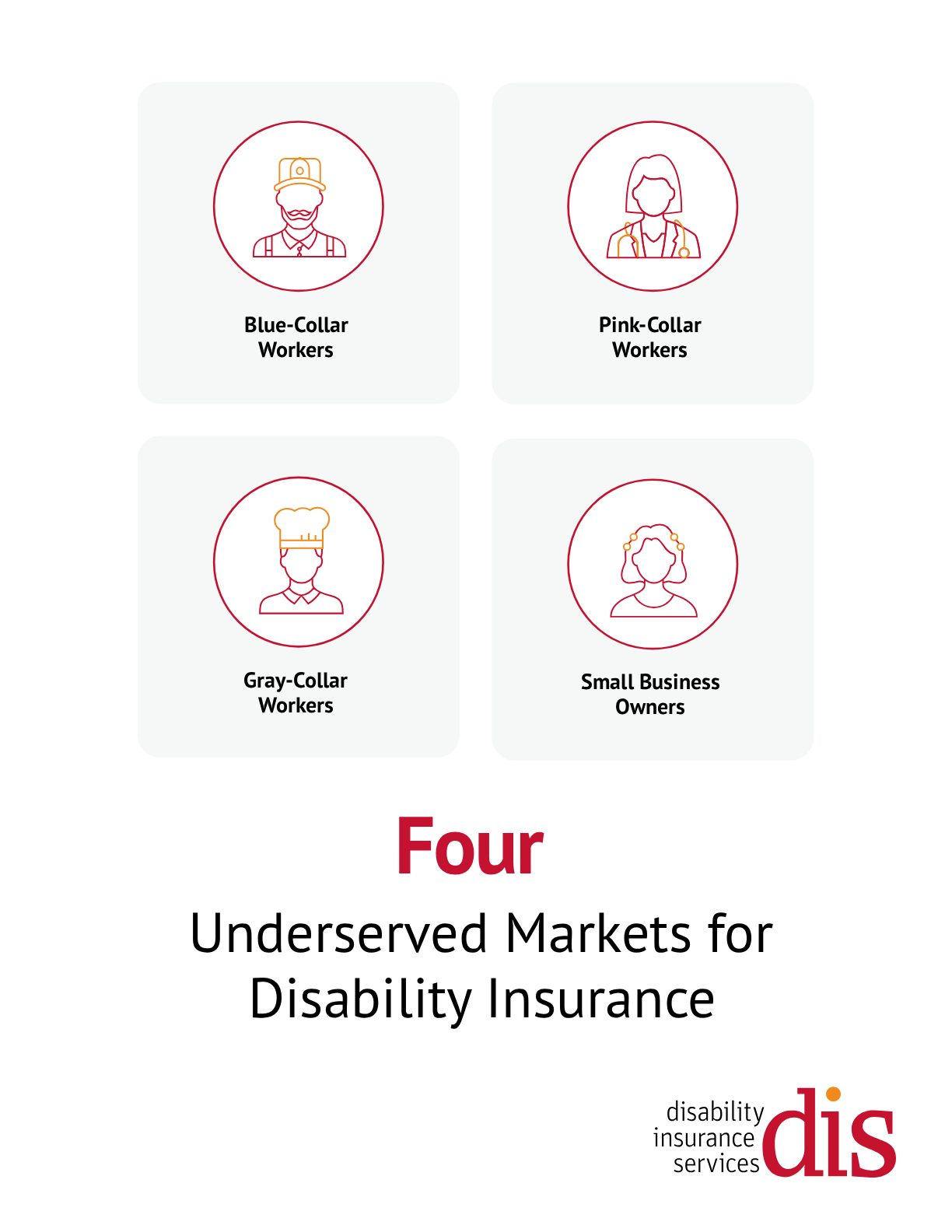

Is a business owner a blue-collar worker or a white-collar worker?

It’s good to be ambitious, but you also need to be realistic. If you pick impossible goals, you’re setting yourself up for failure.

This Thanksgiving, and throughout the holiday season, families will give thanks for their loved ones

On May 6, 2023, Chris Wolfgram’s life changed in an instant.

Let’s say you want to sell 100 policies. You could achieve this by selling a single policy to 100 different clients

The pool of candidates for disability insurance might be larger than you realize.

According to Indeed, the average insurance sales agent in the U.S. earns $64,237 a year.

You’ve heard it a million times. Disability insurance is expensive, and people don’t want to spend money on an insurance product

DI Broker Bob Damato was nearly killed by an unexpected stroke.

Don’t think disability insurance can happen to you? Think again.

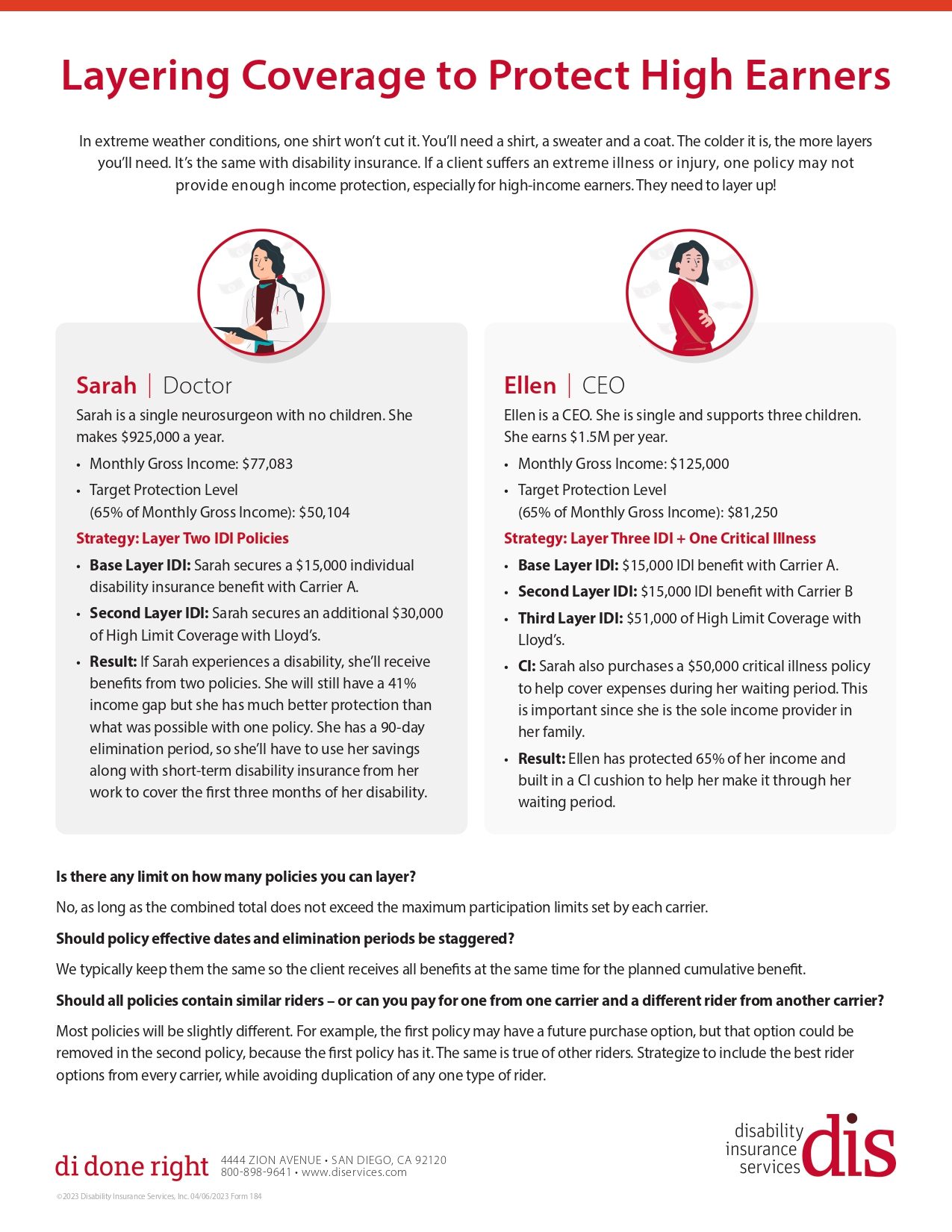

In extreme weather conditions, one shirt won’t cut it. You’ll need a shirt, a sweater and a coat.

Financial Planners: Increasing Assets Under Management is a win-win for your clients and for you.

We’ve all heard the phrase, “Garbage In, Garbage Out.” It certainly rings true in disability insurance quotes.

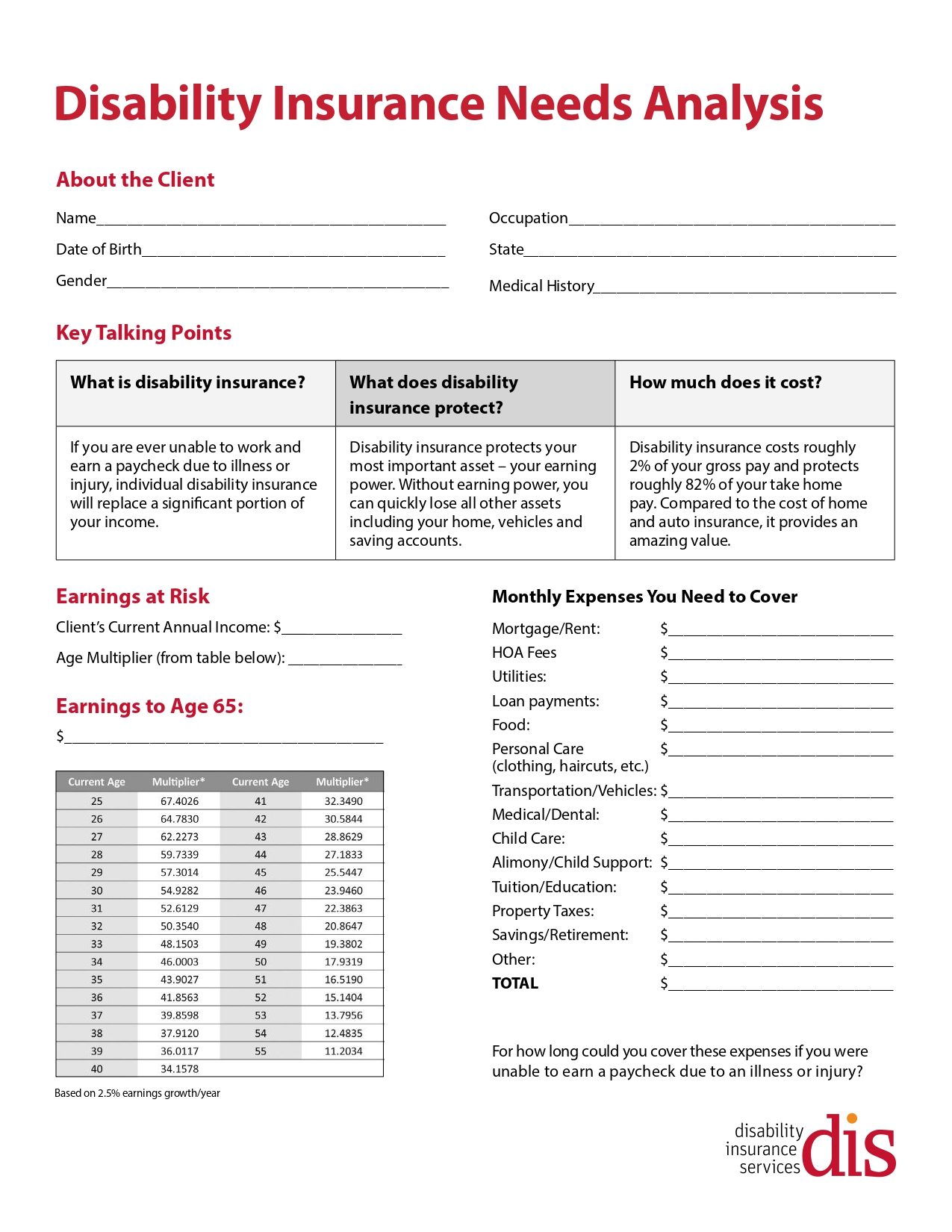

Disability Insurance Needs Analysis

When business partners create a company together, they have big hopes for the future.

Americans need a new way to pay for long-term care.

If a disability insurance policy has a 90-day waiting period, how long do your clients have to wait before receiving payment?

The IRS Code 162 executive bonus plan is another tool businesses can use to attract, motivate, reward, and retain key employees.

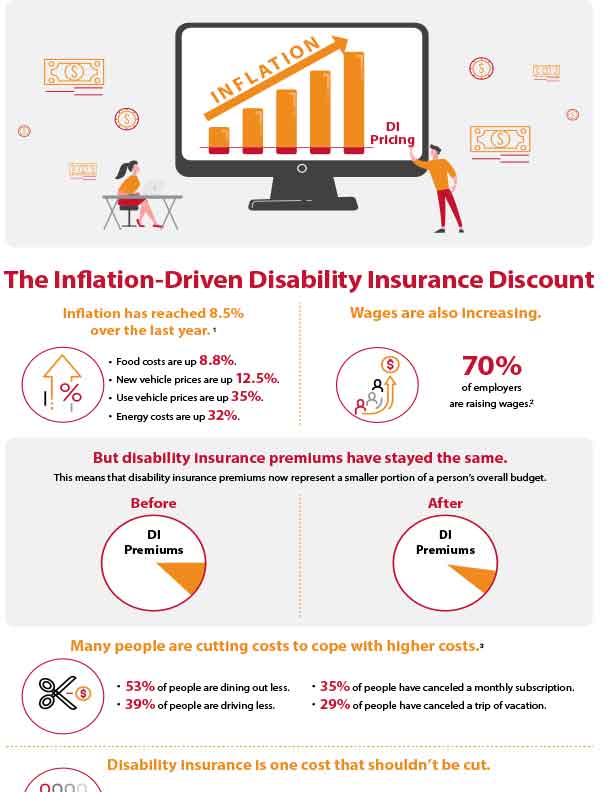

The Inflation-Driven Disability Insurance Discount

Traditional employment is becoming less common. This means that traditional employee benefits are also becoming less common.

The health care industry is seeing rapid growth as the population ages.

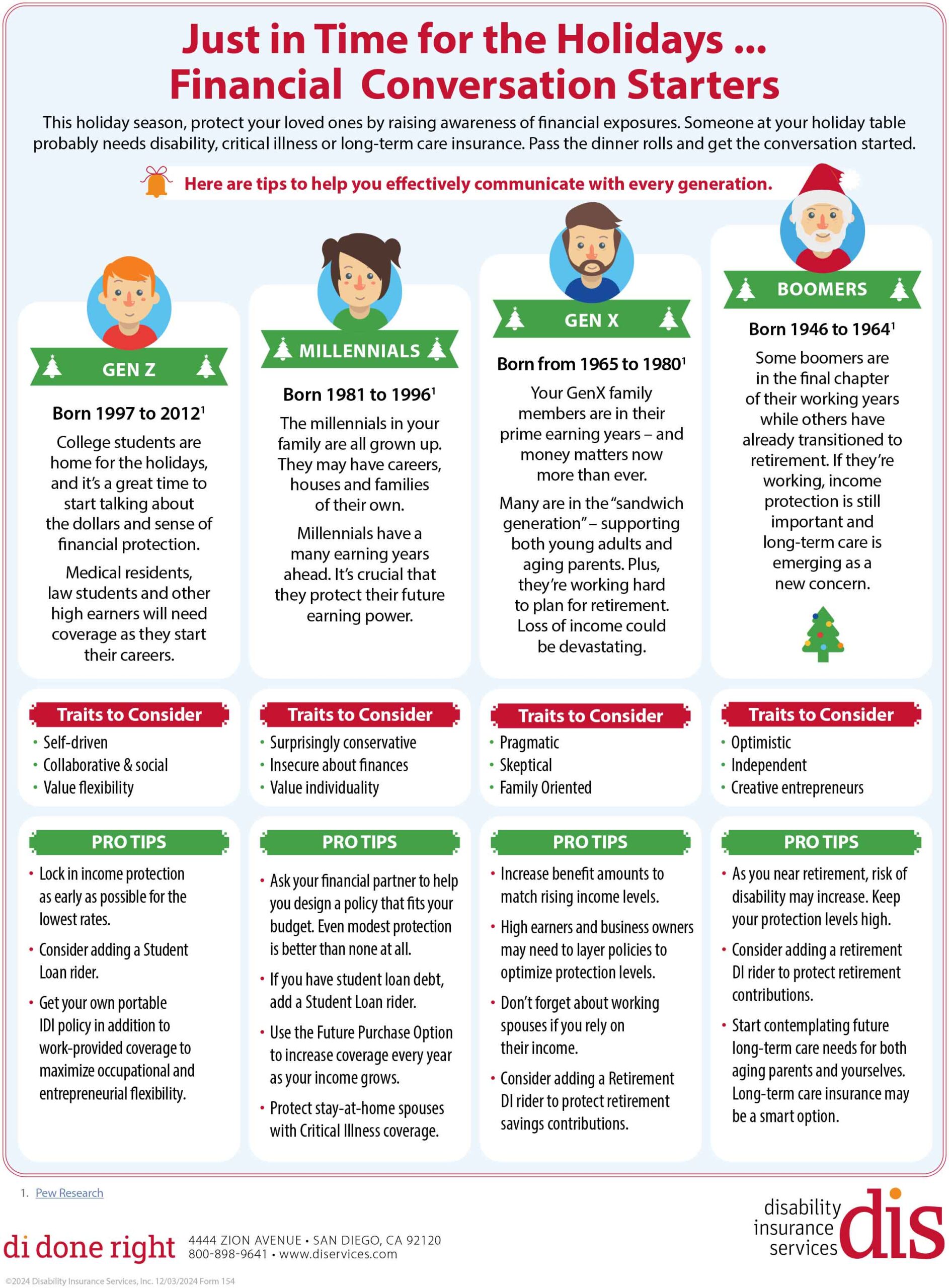

This holiday season, protect your loved ones by raising awareness of financial exposures.

Accountants understand the importance of cash flow.

Common mistakes can gobble up your income and earning power.

Like doctors, dentists, engineers and other highly-paid professionals, attorneys desperately need individual disability insurance.

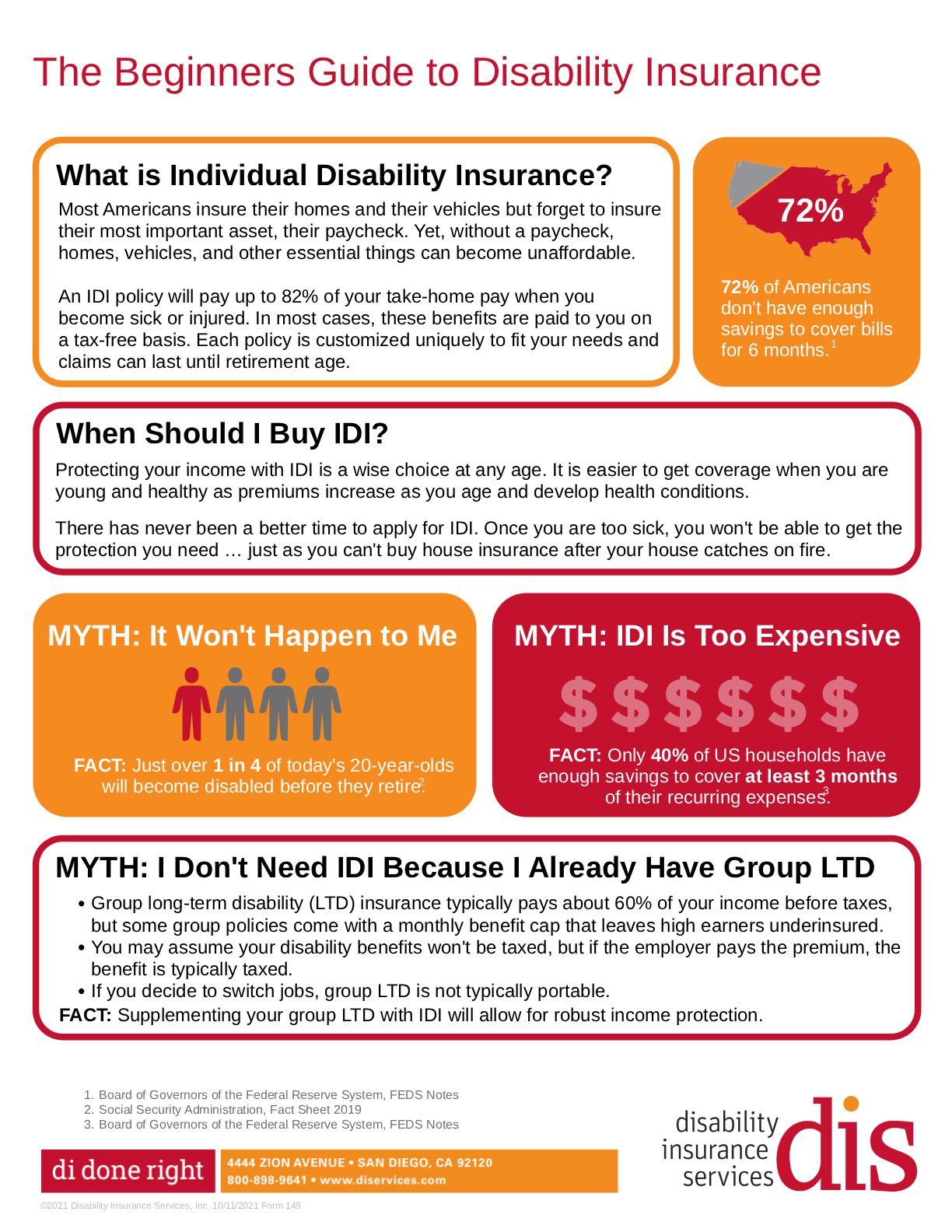

Most Americans insure their homes and their vehicles but forget to insure their most important asset, their paycheck.

What's Scarier Than Halloween? Disabilities That Suck Your Income Dry.

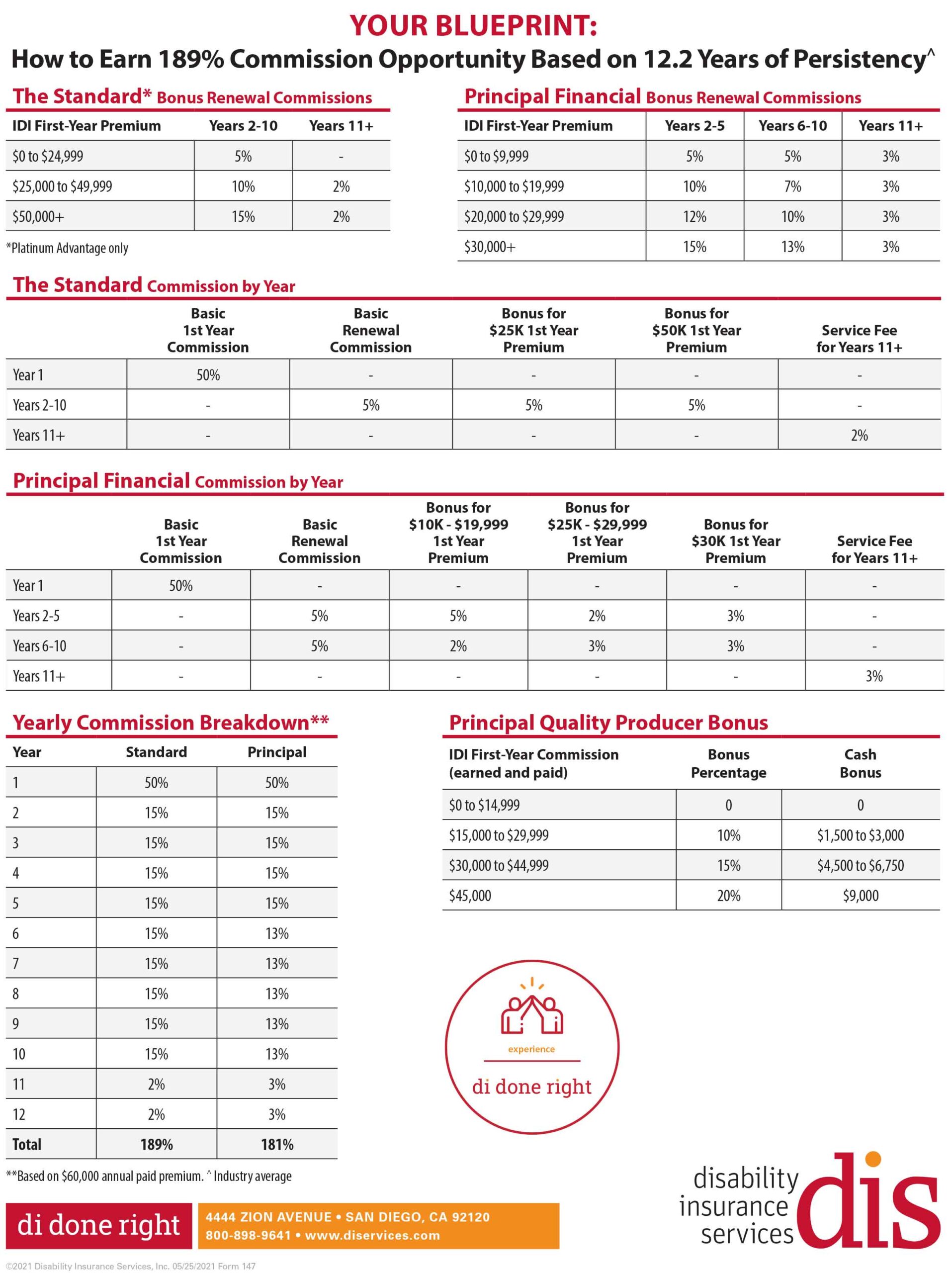

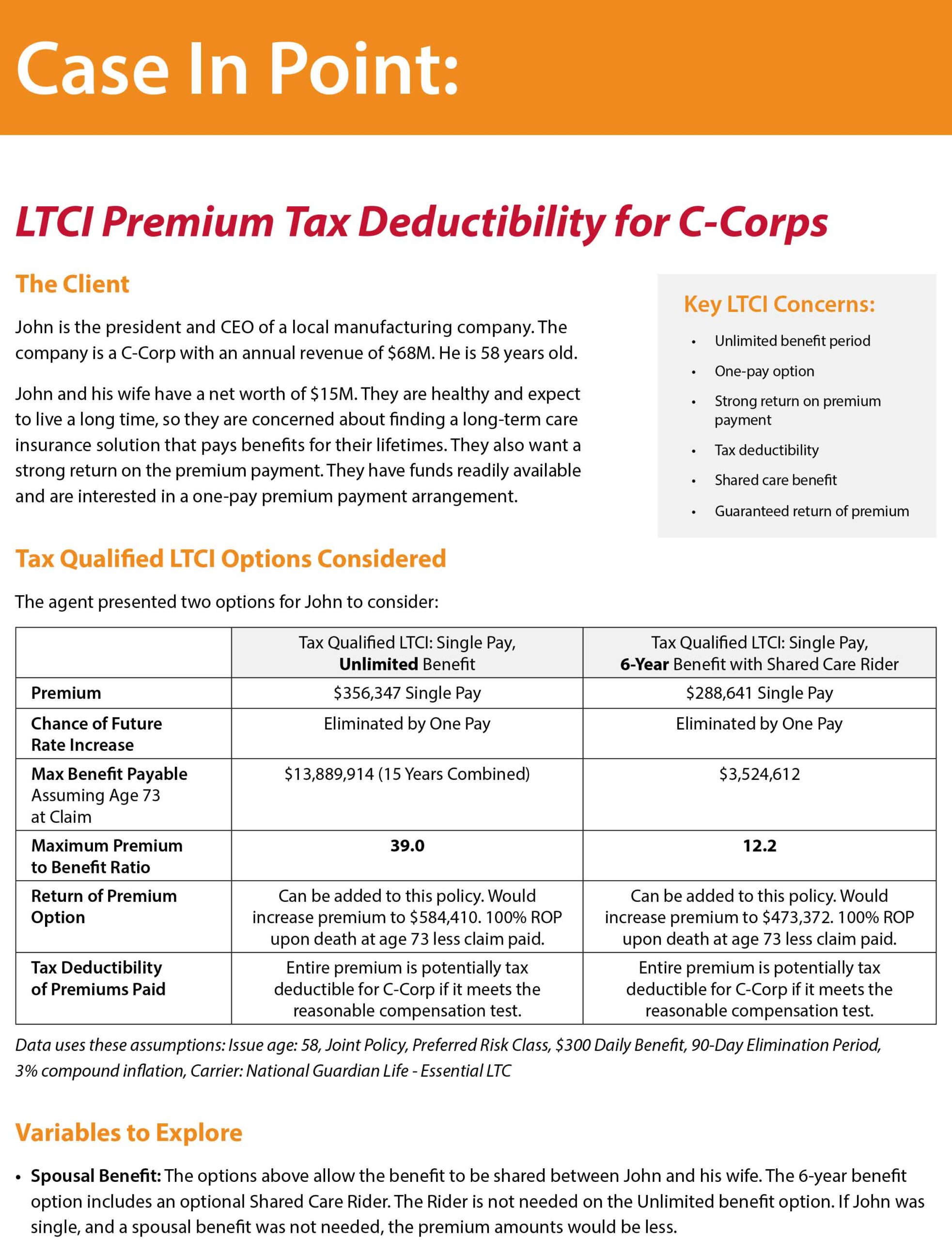

How to Earn 189% Commission Opportunity Based on 12.2 Years of Persistency

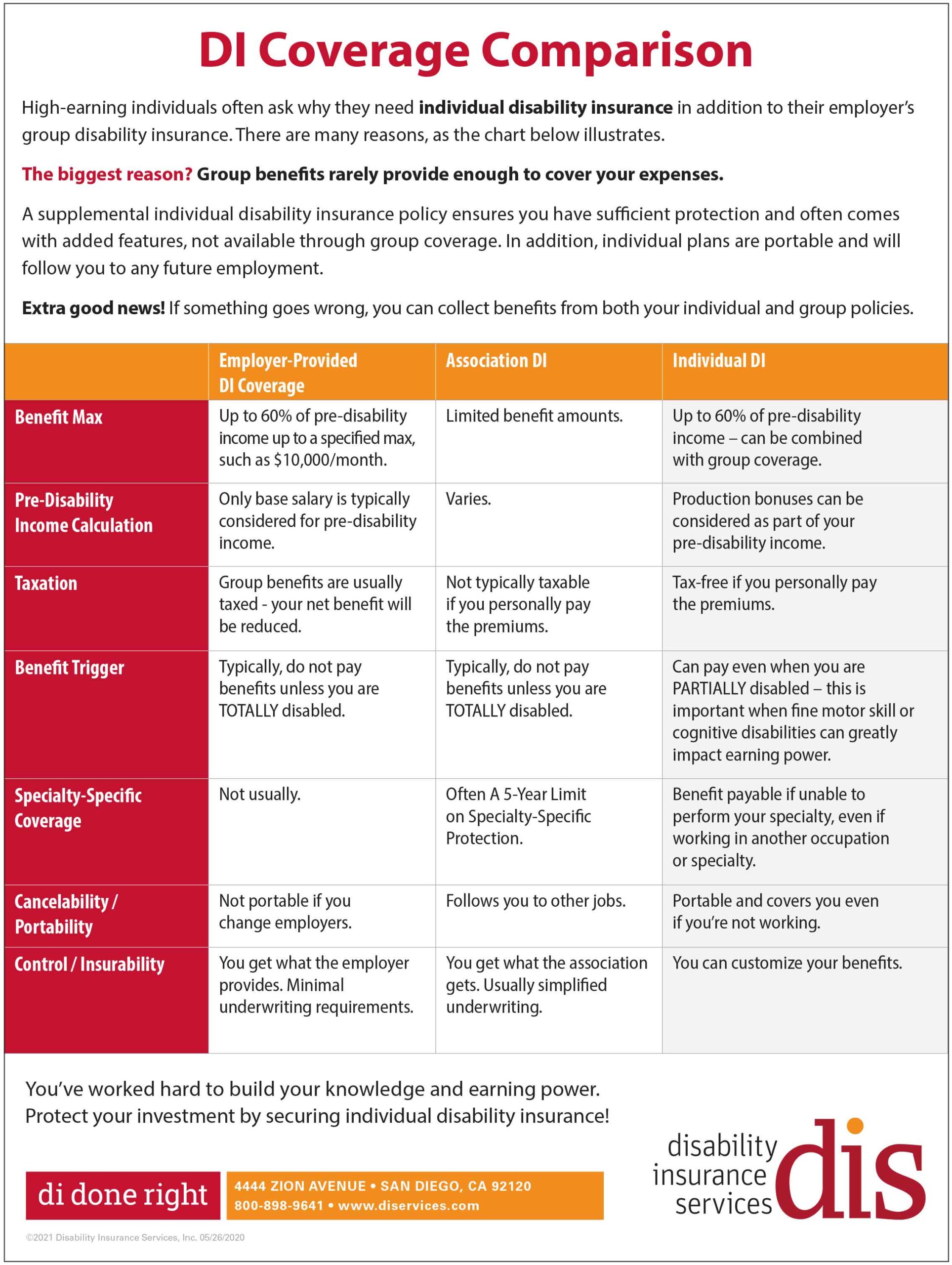

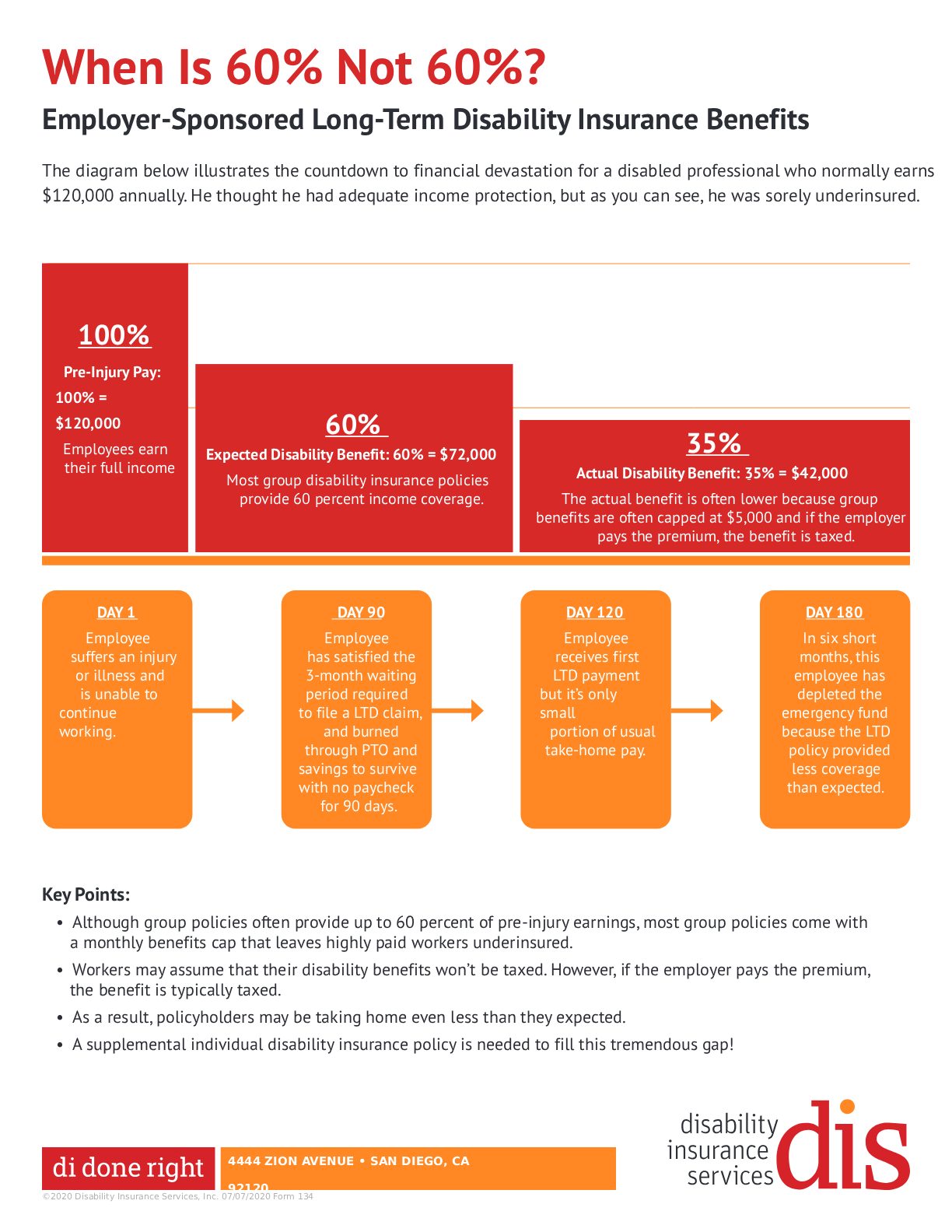

High-earning individuals often ask why they need individual disability insurance in addition to their employer’s group disability insurance.

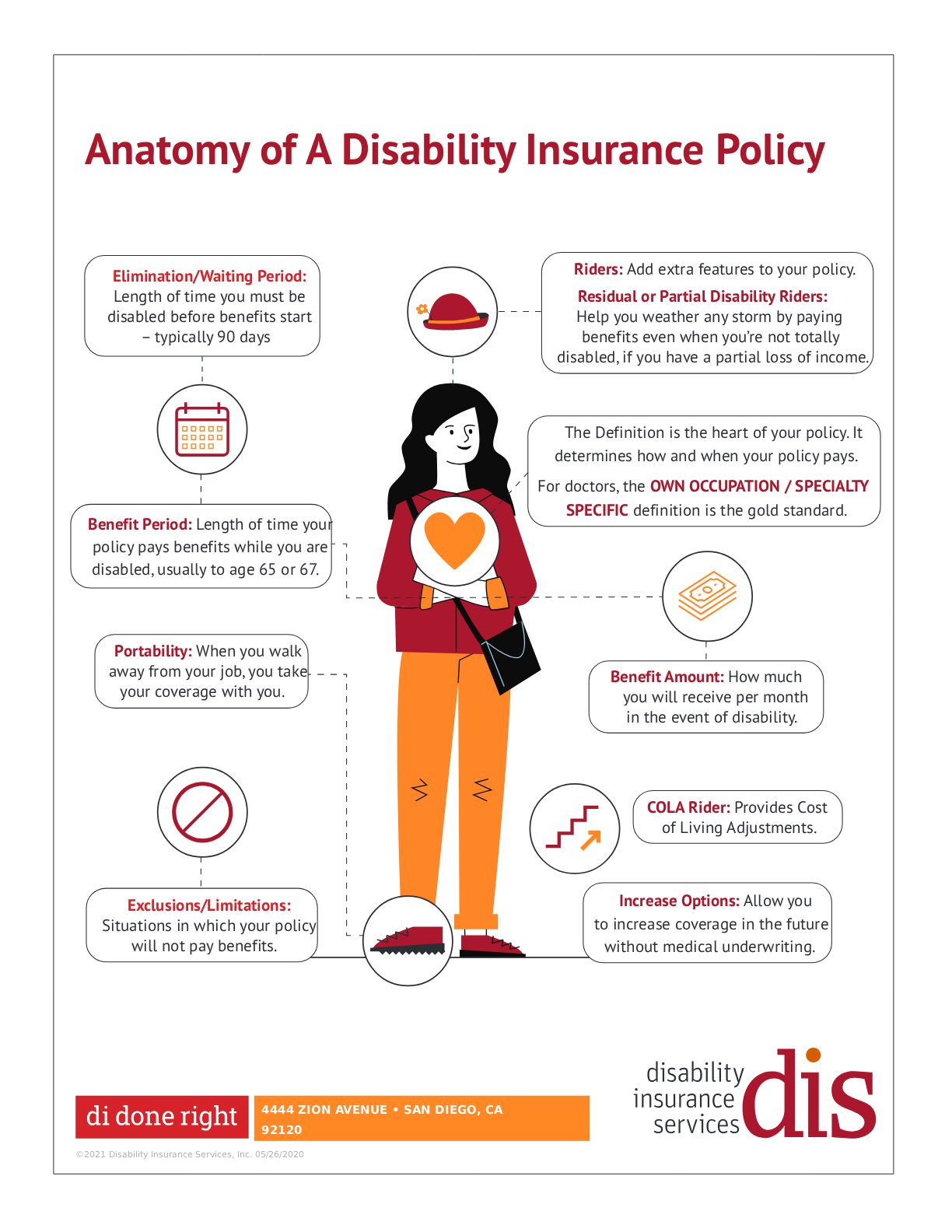

Anatomy of A Disability Insurance Policy

With so many mass email blasts going out every day, your prospects’ inboxes are more crowded than ever.

What if your disability insurance clients could get more coverage with no medical underwriting?

Have your clients recently purchased a new house or remodeled an existing one?

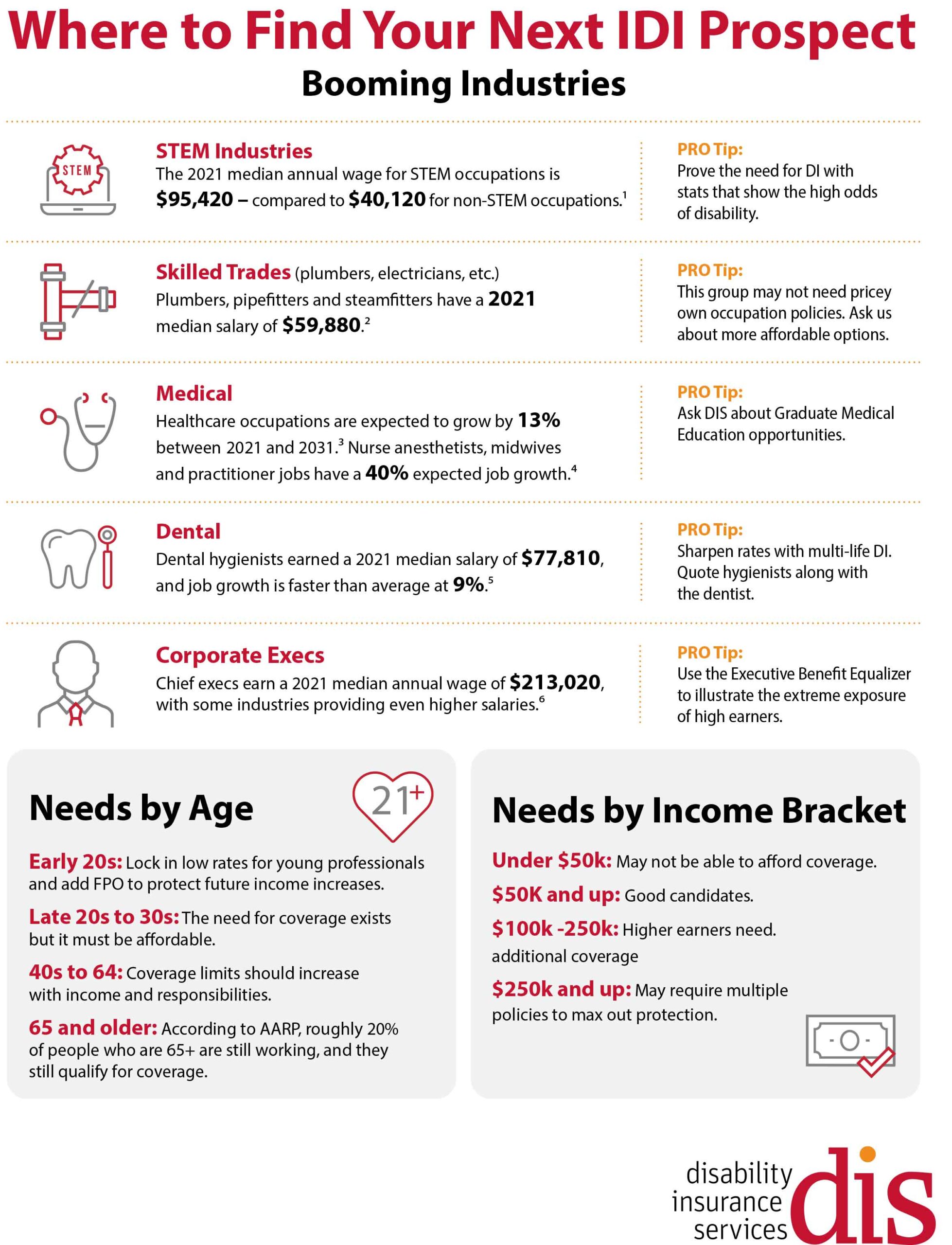

The 2021 median annual wage for STEM occupations is $95,420 – compared to $40,120 for non-STEM occupations.

The Executive Benefit Equalizer helps you illustrate the extreme disability risk that so many highly-compensated executives face

Your goal: make the risk real. Tap into fear, emotion and reality.

The diagram below illustrates the countdown to financial devastation for a disabled professional who normally earns $120,000 annually.

If for some reason, you decide to forego coverage at this time, please kindly sign the Waiver of Liability

John is the president and CEO of a local manufacturing company. The company is a C-Corp with an annual revenue of $68M.

A large accounting firm in Dallas was concerned about protecting its talent and revenues.

In May 2009, Sysco employee Dustin King was involved in a four-wheeler accident that paralyzed him from the neck down.

A local non-profit hospital client underwent an extensive search for a new Chief Executive Officer.

A local non-profit hospital client underwent an extensive search for a new Chief Executive Officer.

A law firm employed several high income earners who needed more protection

After closing a $12 million employer-sponsored 401(k) plan, the producer asked the company CEO

In addition to providing a full scope of financial planning services, advisor Mike Daly has achieved great success with business loan

If the pandemic taught us anything, it’s that life changes in an instant.

Starting and running a business – or funding an expansion – can be an expensive proposition.

There are some 7.4 million businesses operating as partnerships in the United States

Impact players. Every business has them. They can be an owner, product guru or that office manager

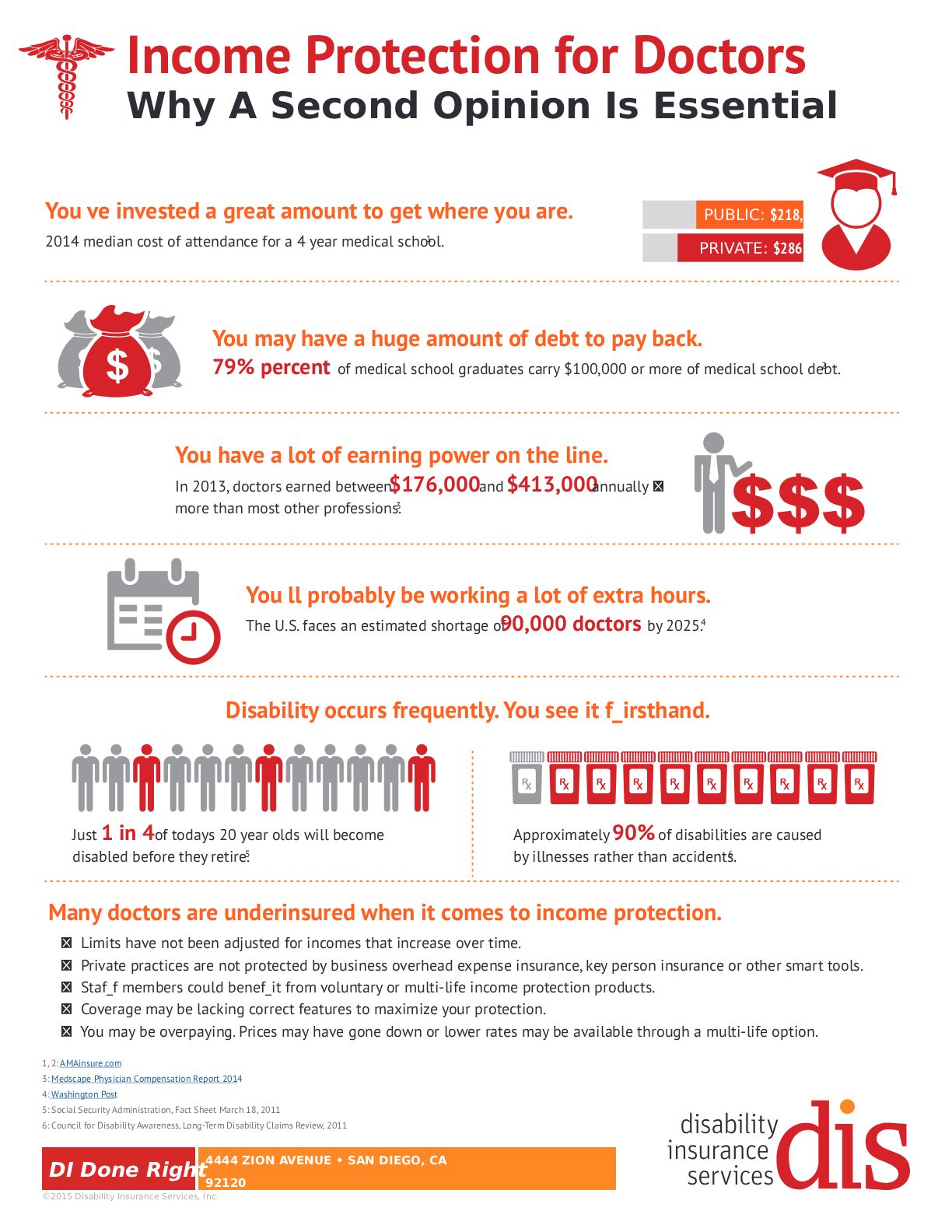

Many doctors are underinsured when it comes to income protection.

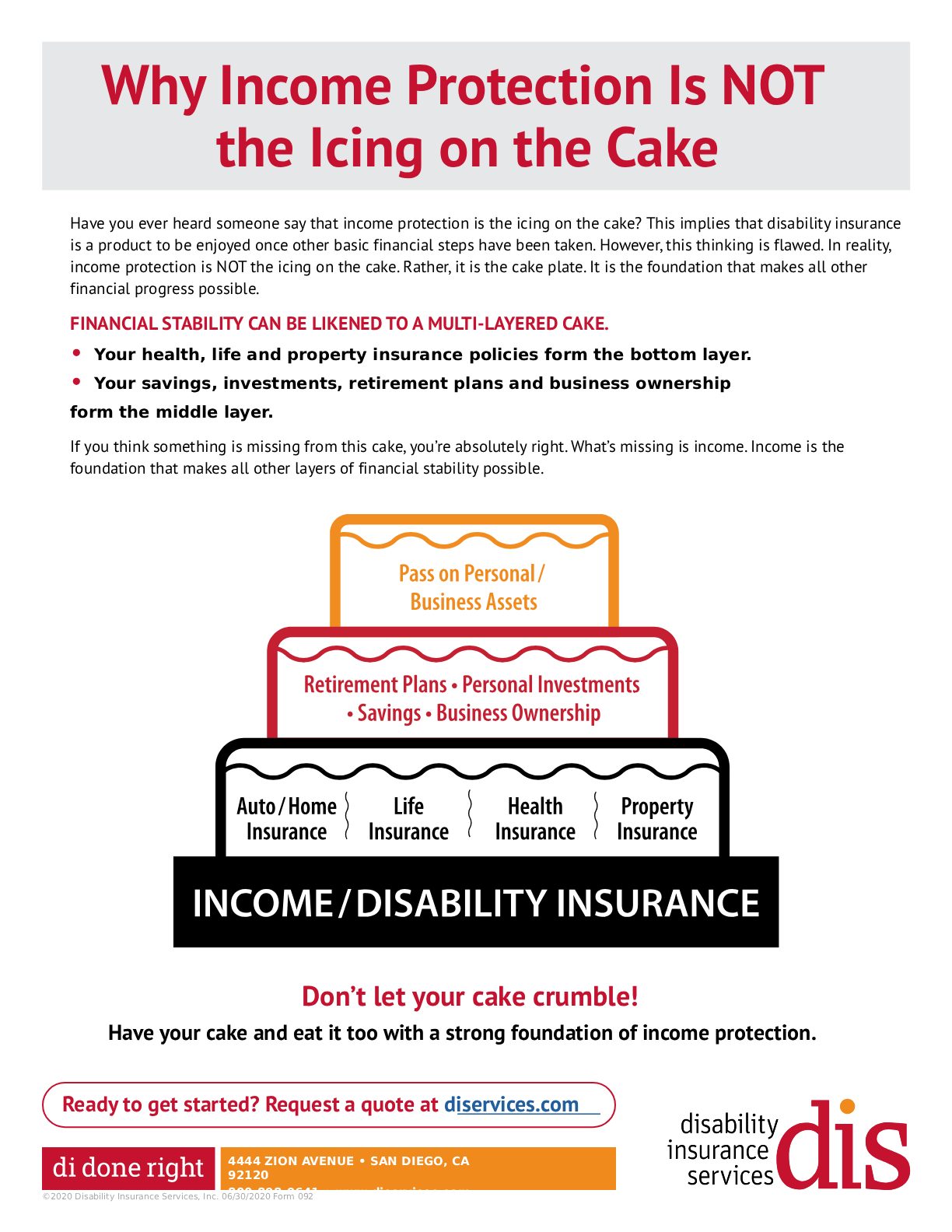

Have you ever heard someone say that income protection is the icing on the cake?

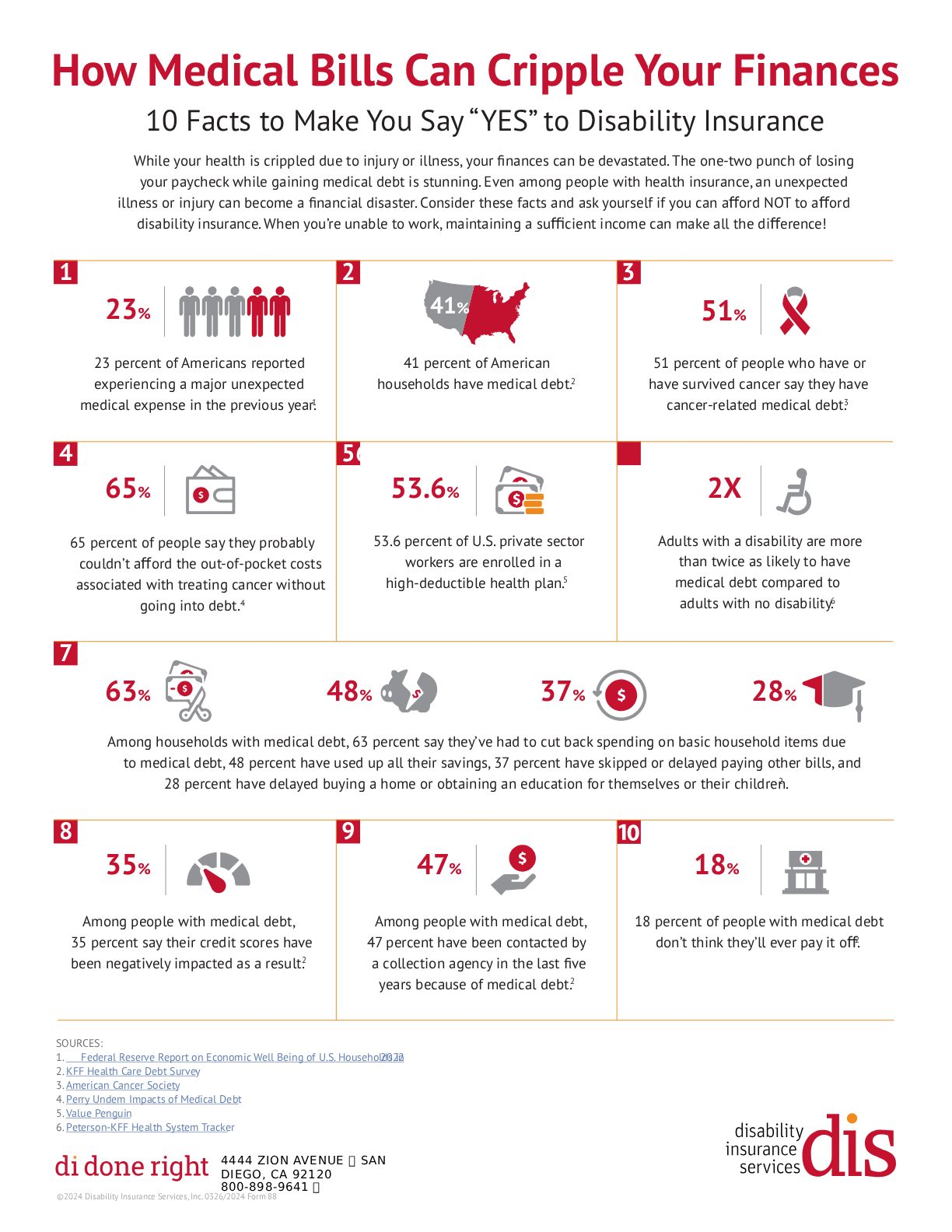

These numbers show why every working American needs paycheck protection.

In the world of income protection, there’s no better market than physicians.

While your health is crippled due to injury or illness, your finances can be devastated.

The Face of Disability Could this be you or someone you know?

Below are three key coverages that help shelter your financial assets throughout your life.

Why do Americans forget to insure their paychecks? Because they usually believe one of these disability insurance myths

Only 22.7% of people with disability worked in 2024, according to BLS, compared to 65.5% of people without disability.

As the Baby Boom generation ages, so too will rates of Alzheimer’s: 5% of people ages 65 to 74 have Alzheimer’s

Those who reach age 65 have an average life expectancy of an additional 19.2 years (20.4 years for females and 17.8 years for males).

$475.1 billion. That is the staggering amount spent on long-term care services and support in the U.S. in 2020.

DIS partners with the nation’s leading carriers to ensure you get the best product and the best price for every client.

When your prospect presents an objection to LTCi, or any product for that matter, it doesn’t have to be a stumbling point.

Long-term care insurance is intended to relieve some of the financial drain of long-term custodial care.

The best conversations about aging and end-of life care happen well before they are needed.

A few years ago, the U.S. Census Bureau published a report called “The Next Four Decades,”

Upon diagnosis of a covered critical illness, you receive a lump sum payment.

Upon diagnosis of a covered critical illness, you receive a lump sum payment.

The Vegas Strip is known for glitz, glamour and gambling. And, at one prominent Vegas hotel/casino, employees are getting in on the action

Tell previously declined clients “YES” with our simplified issue DI.

Many employers are unknowingly discriminating against their most valuable team members.

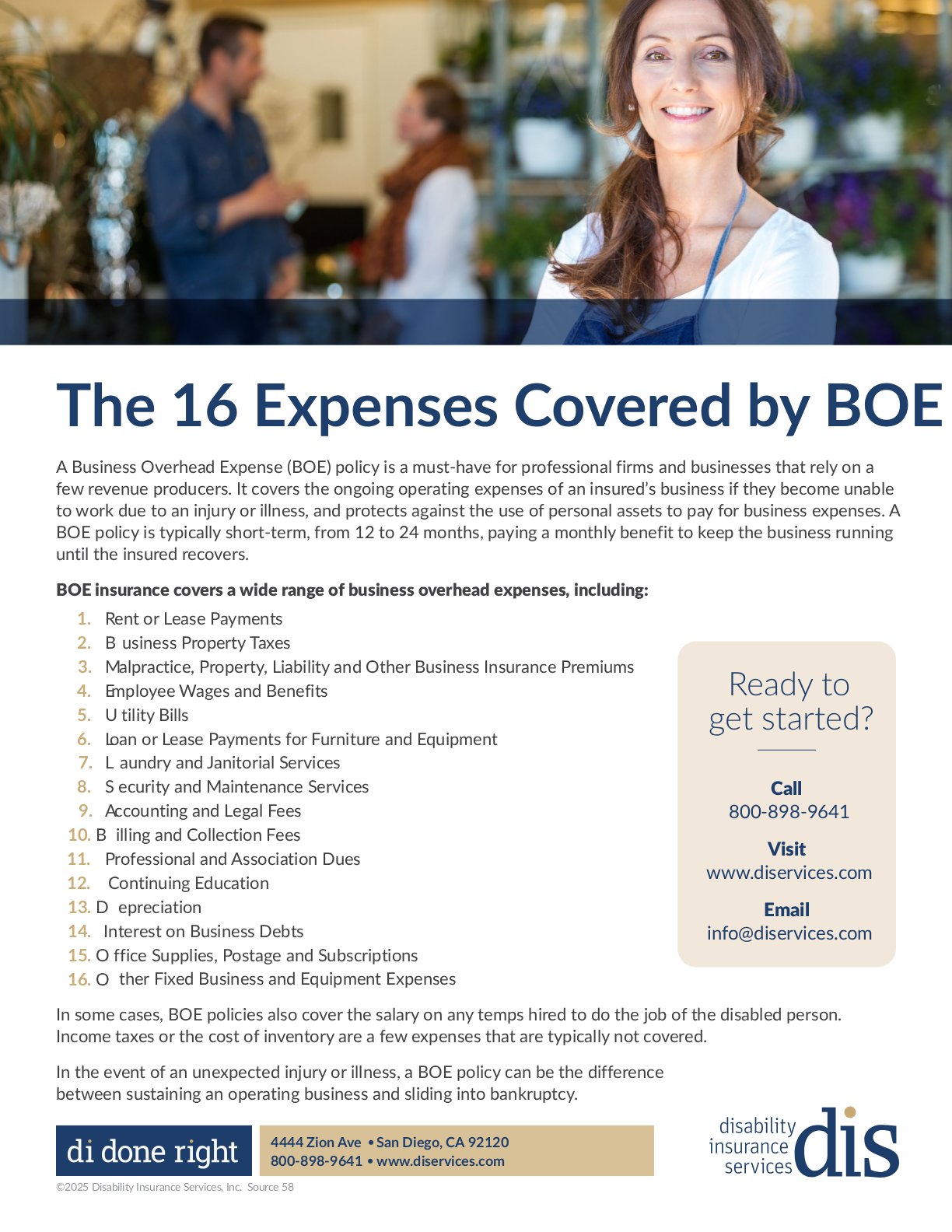

A Business Overhead Expense (BOE) policy is a must-have for professional firms and businesses that rely on a few revenue producers.

A Business Overhead Expense (BOE) policy is a must-have for professional firms and businesses that rely on a few revenue producers.

The Graduate Medical Education DI market could be just the opportunity you need.

There are 79 million working women in the U.S. labor force, according to BLS. They are our mothers, sisters, friends and daughters.

In their 20s or early 30s, early career workers are just getting established in their careers.

How to maximize your disability coverage, get the best possible definitions and save the most money.

Looking for a new segment for disability insurance marketing? The facts make a strong case for concentrating on the IT industry.

If you're like most agents, you may not be sure about some of the finer points.

I believe that the sale that opens the most doors to the future is the MOST IMPORTANT sale you'll ever make.

How to present an eye opening (and checkbook opening) “apples-to-apples” comparison

In response to the lagging economy and lackluster life sales, many producers are renewing their focus on disability insurance

you know that developing DI expertise and selling proficiency is a challenge.

Use These DI Email Templates with Your Personalized Quote Engine!

Much like you, W.T. Ty Kailey, CLU, CIC, LUTCF, is an insurance agent. Twenty years ago, he had a thriving career as the life/health

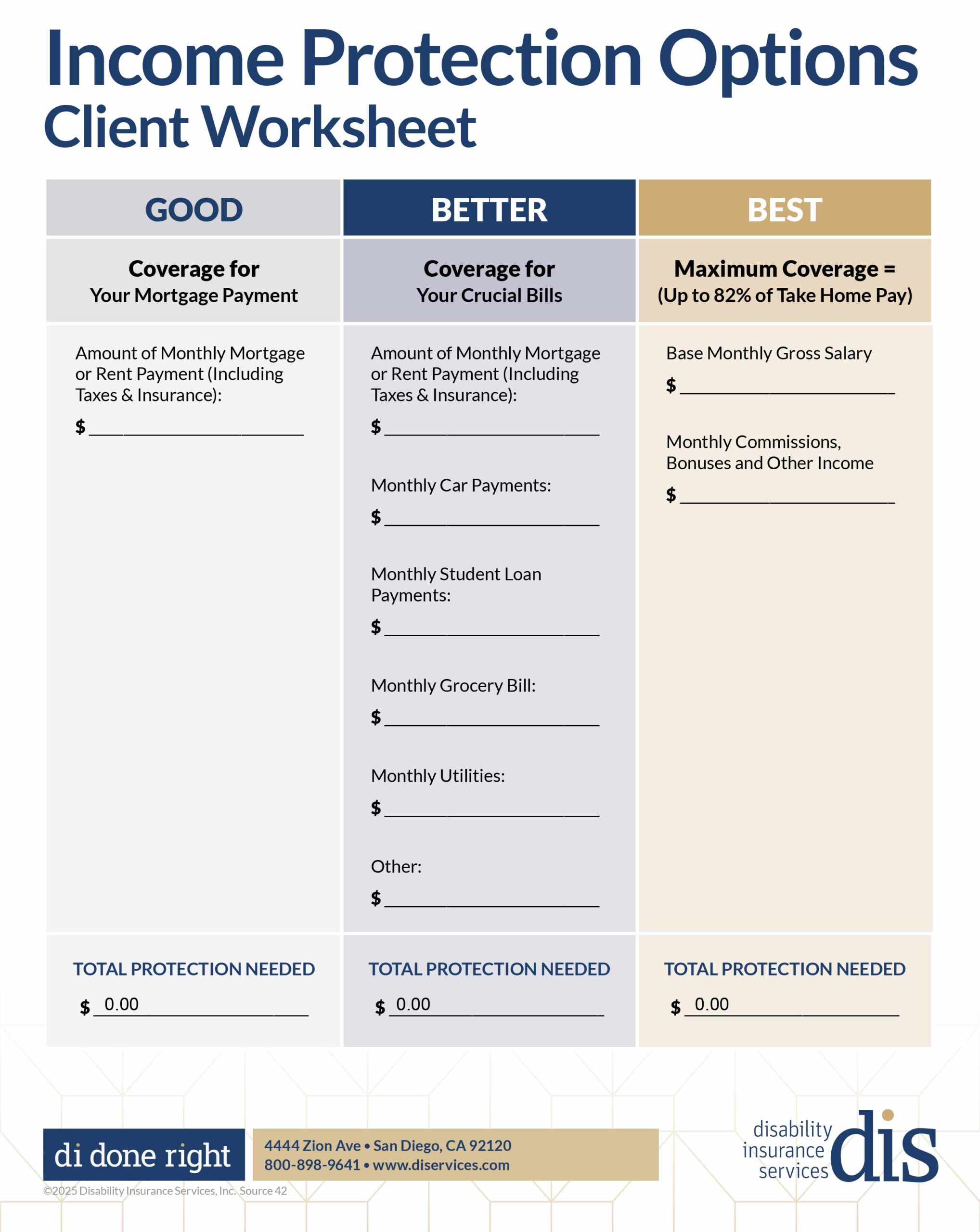

Income Protection Options Client Worksheet

If you find yourself struggling with the plethora of disability terms, don’t worry! You’re not alone.

No, we’re not talking about peanut-butter and jelly or Peanut Buster Parfaits. In fact, this policy advantage is far tastier

Business owners are one of the top markets for selling disability insurance.

For years, we’ve been told that we should only quote non-cancelable and guaranteed renewable policies.

How much LESS would the fast food giants earn if they stopped offering fries and a drink? Of course

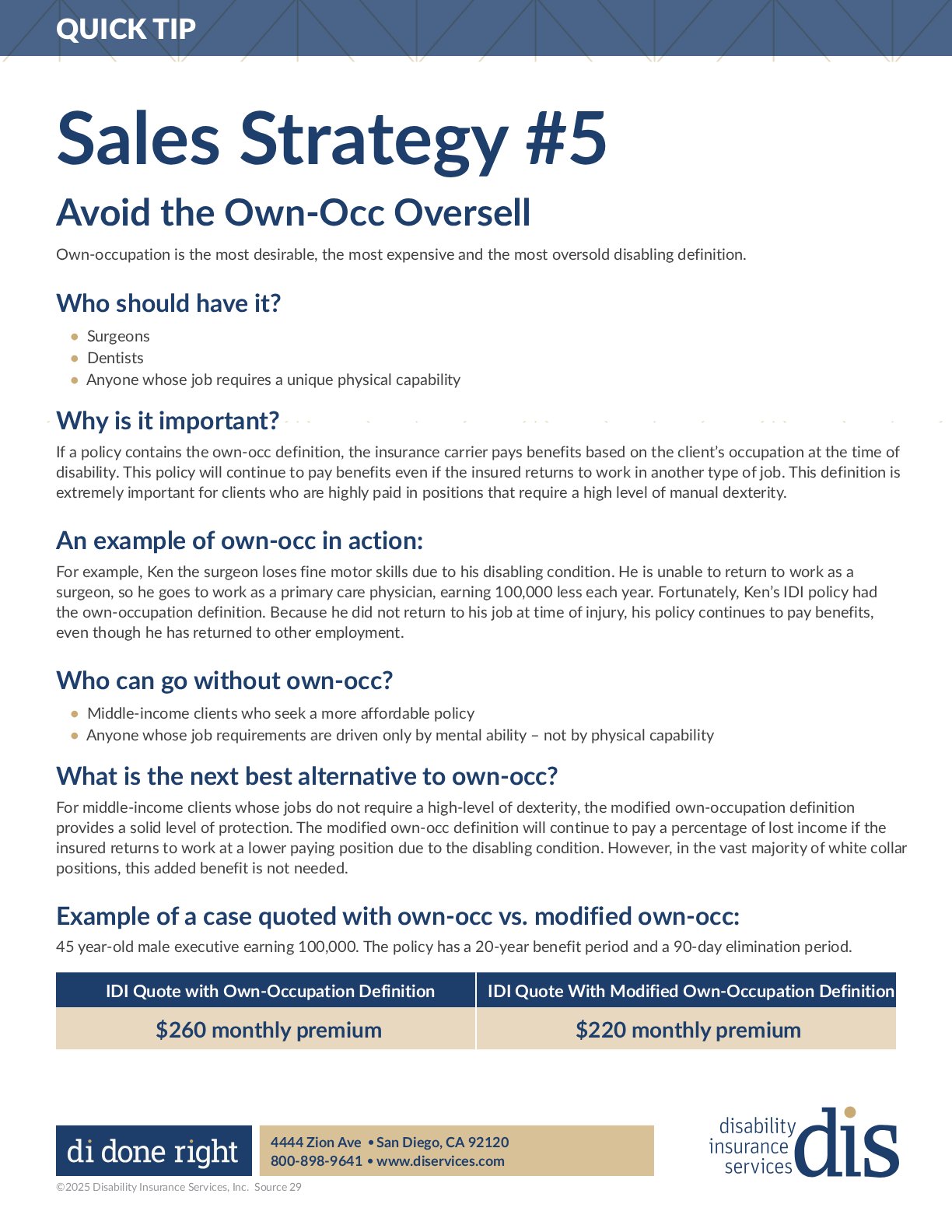

Own-occupation is the most desirable, the most expensive and the most oversold disabling definition.

Financial Planners: Increasing Assets Under Management is a win-win for your clients and for you

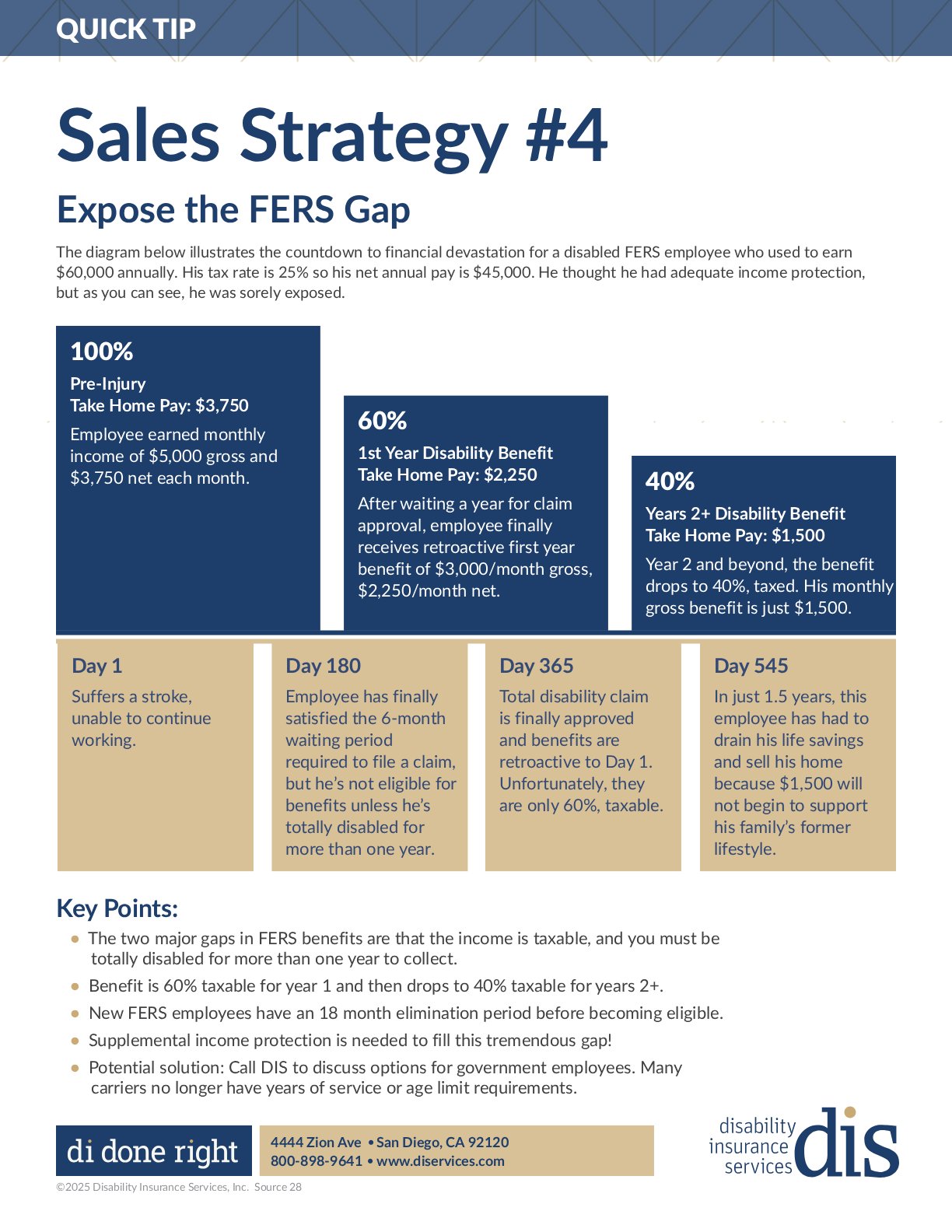

The diagram below illustrates the countdown to financial devastation for a disabled FERS employee who used to earn $60,000 annually.

Does your plan have a “true own occupation” definition.

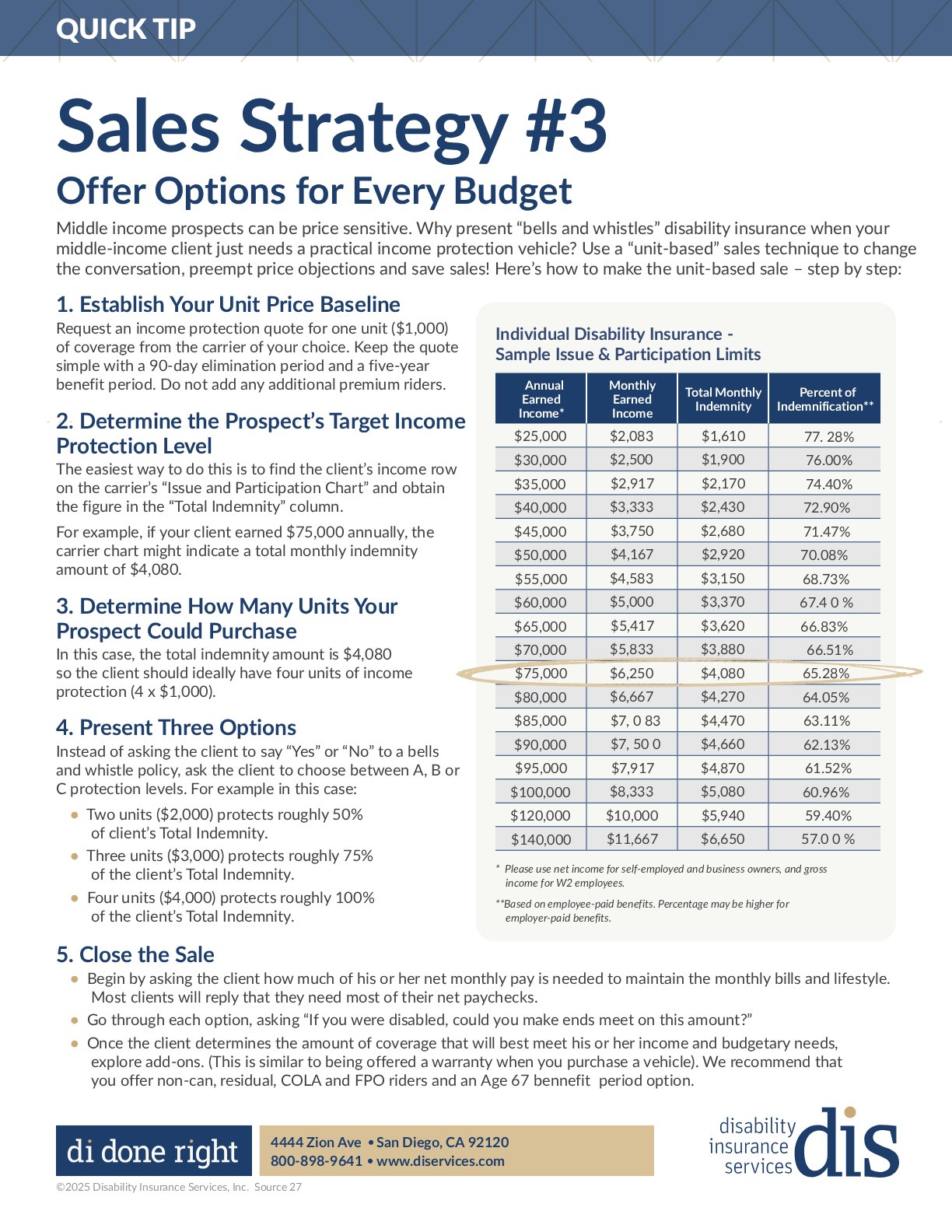

Middle income prospects can be price sensitive. Why present “bells and whistles” disability insurance when your middle-income

Imagine that you had free access to an audience of hundreds, thousands or even millions of people.

If the client’s IDI policy includes a 90-day elimination period, the Critical Illness policy can help fill the income gap

The health care industry is booming thanks to an aging boomer generation; longer lifespans; and improved access to health care.

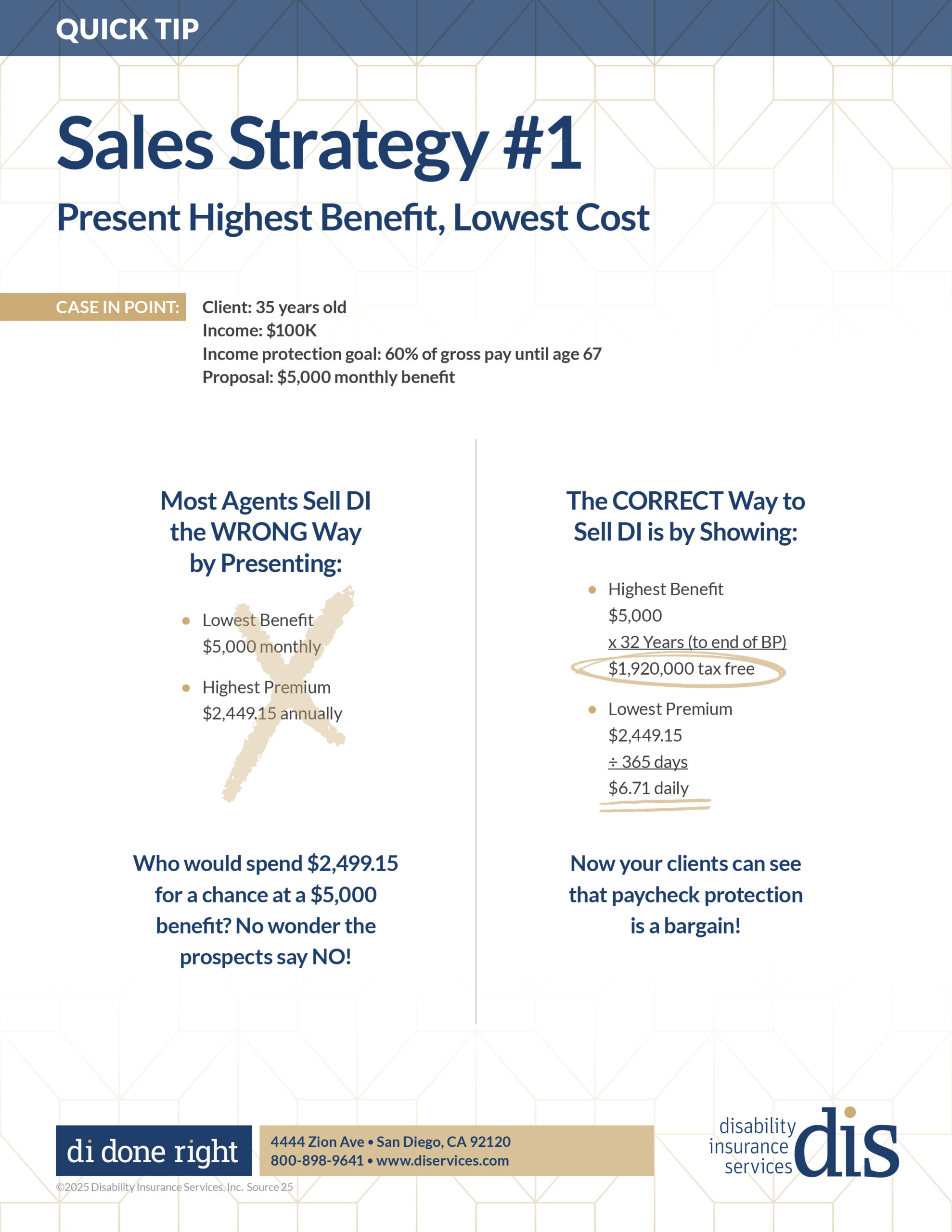

Sales Strategy #1 Present Highest Benefit, Lowest Cost

7 Things to know before your next appointment.

How to Build a Thriving Profitable DI Book. Are you thirsty for DI results? Don’t subscribe to these revenue-parching myths!

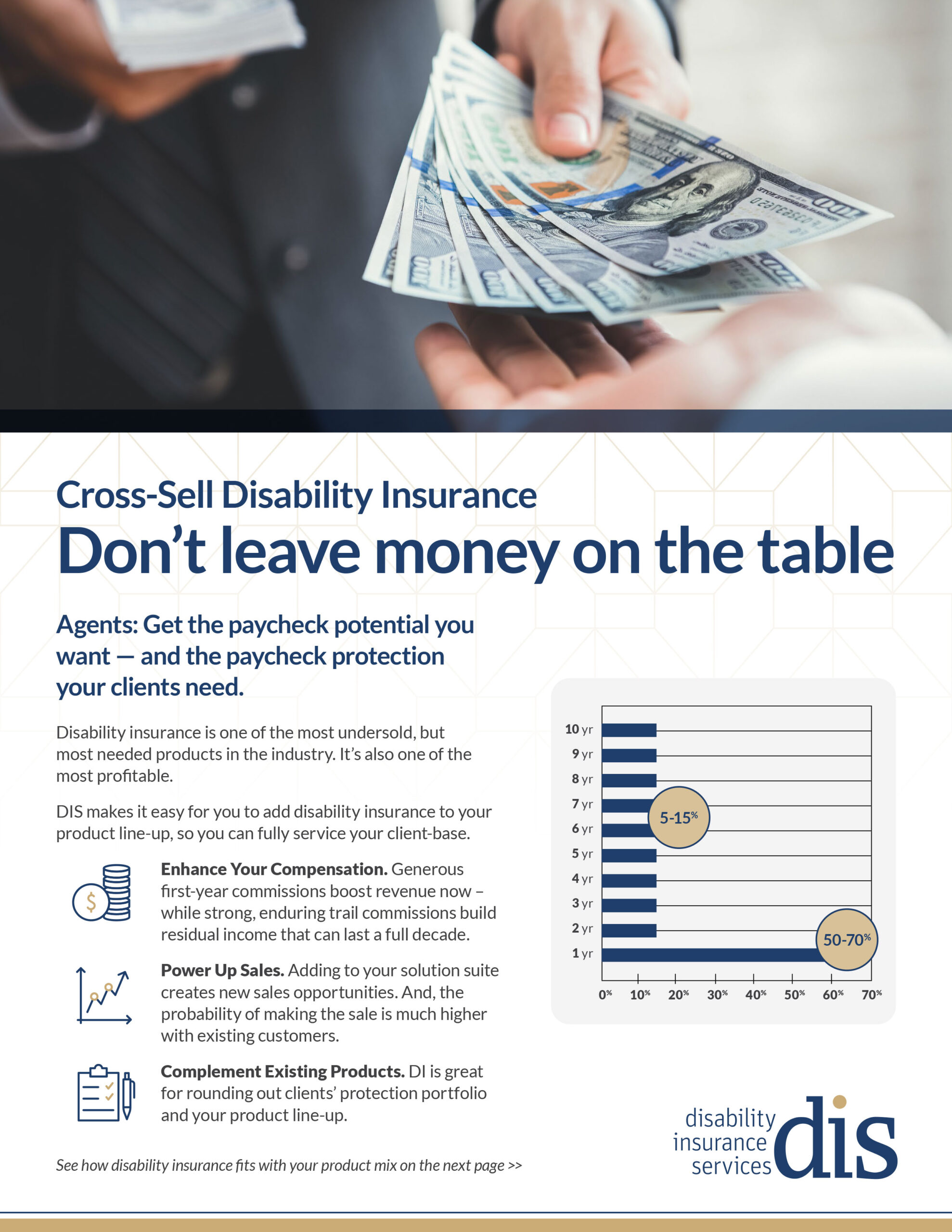

Agents: Get the paycheck potential you want — and the paycheck protection your clients need.

Want a new revenue stream or to grow your DI sales career? Download this proven DI Sales Script.

Disability insurance protects income and powers every financial plan. When you sell life insurance, offer disability coverage too.

Great marketing is a gamechanger in insurance, and it doesn’t have to be expensive. Here are 15 ways to build an impressive brand right now.

DI Marketing Boot Camp makes selling disability insurance simple, no sweat required. Get your free report and discover four of the most profitable DI markets.